Data_Note: Another solid jobs report, though with a few soft spots

The trade war hasn't yet reached the job market (unlike the DOGE cuts). But there are warning signs.

Payrolls rose 139,000 last month and the unemployment rate held steady at 4.2%. It’s another good jobs report, and it shows the trade war hasn’t yet hit the job market. Still, there are a few soft spots that bear watching.

The topline payroll gain beat expectations for 125,000 but negative revisions to March and April took those months’ gains down by a cumulative 95,000. The jobs report contains data from two surveys: payrolls come from a survey of firms and unemployment from a survey of households. The Household Survey was quite soft this month, showing a decline in both the labor force (down 0.2 percentage points) and the share of population with jobs (down 0.3 ppts). If you go out another decimal point, the unemployment rate crept up a touch, from 4.19% to 4.24%.

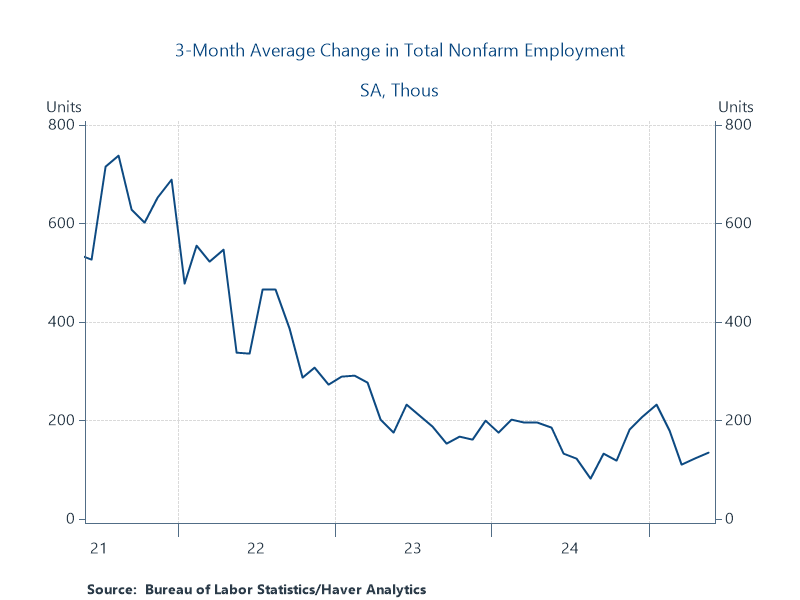

With the revisions, the 3-month average of monthly gains is down to 135,000, well below average gains from a few years ago (see figure). This is what we’d expect as the job market normalized, and the recent average pace is solidly within estimates of the “breakeven” level, meaning the number of jobs needed each month to keep the unemployment rate stable.

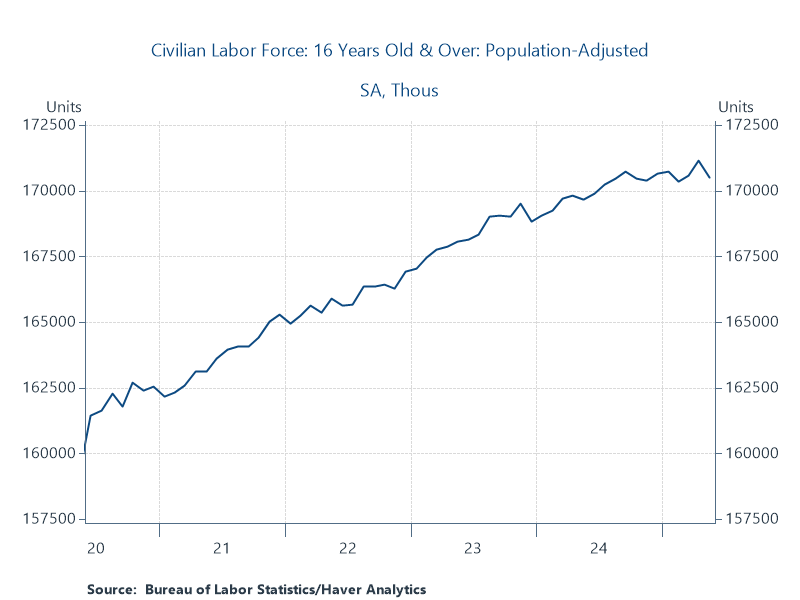

One reason the breakeven-jobs number declines is because the growth of the labor force slows, which has been the case, as shown in the figure below. This series is “population-adjusted” to give a better read of the trend, so I wouldn’t make much of the tick down in May. But it has flattened of late, probably due in part to lower immigration flows, and that means we need fewer jobs to hit breakeven.

While the topline number was solid, federal workers have clearly been hit by DOGE layoffs. Jobs in that sector fell 22,000 last month, making this the fourth month in a row of job losses, for a cumulative loss of 59,000. That’s not a huge number in a labor market where total payrolls are just under 160 million, but it’s a clear sign of DOGE’s impact.

Given the importance of both workers’ living standards and real consumer spending, I always like to check in with wage growth. In May, nominal wages were up 3.9% for all private-sector workers and 4% for middle/lower-wage workers. In fact, both series have been pretty much parked at that growth rate since mid-2024. In terms of real wages, the April CPI—we don’t yet have May’s price data—was up 2.3% on a yearly basis, and even if the tariffs juice May’s CPI data, we can be confident that real wages were up at a solid pace last month, as they have been consistently since May of ‘23. That’s good news for consumers which should help provide momentum for the ongoing expansion.

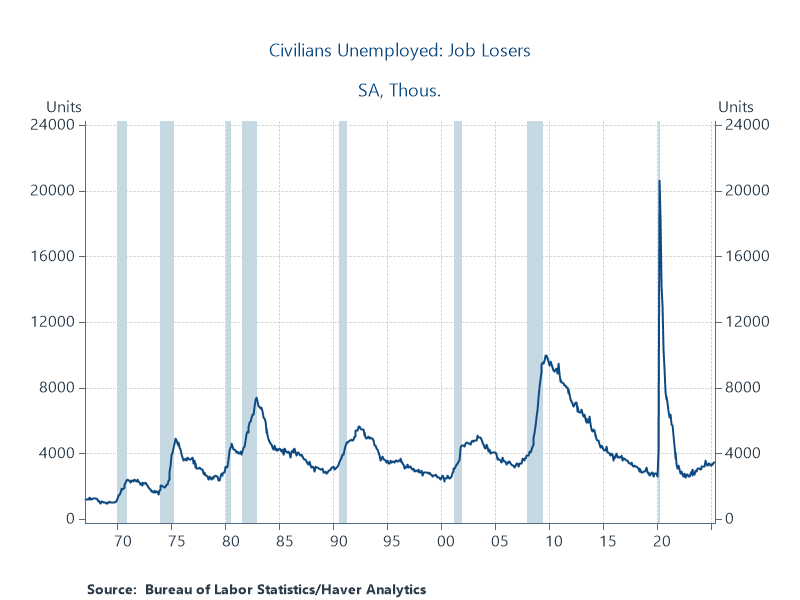

A key variable to watch right now is layoffs. As discussed in more detail below, we know hiring has slowed but, as the figure below shows, there is no labor market downturn without layoffs. Yes, there’s a bit of an upward tilt at the end of that series, which I don’t like anymore than you do, and layoffs are up 470,000 over the past two years, but this series is clearly not yet flashing red.

Finally, there some sectoral softness in the payroll numbers. Diffusion indices ticked down for both all private (neutral, at 50%, meaning half of the sectors expanded and half contracted) and for manufacturing (41.7%, meaning more contracting than expanding). Factory jobs were down 8,000 in May and down 88,000 over the past year. I’ll dig into this more later, but we may be seeing some early tariff impacts in sectors exposed to import taxes, such as factory work and transportation/warehousing, which has slowed in recent months.

What’s happening here is that employers are in a similar wait-and-see mode as the Federal Reserve. Both are not yet sure what the trade war will do to their businesses (employers) or inflation and growth (the Fed). In fact, with all the on-again, off-again it’s impossible for either of these important economic actors to know the magnitude of the trade war, so let me close with a note on the ensuing uncertainty.

The trade war has us all on shpilkes

There’s a lot of nervousness about where the job market is headed, which makes sense as it has been a major and reliable driver of the current economic expansion, now in its fifth year. Labor market analysts are waiting for the shoe to drop from the trade war. We know from both anecdotes and trade data (which show a huge import surge of tariff front-running, followed by an equally sharp reversal) that on the back of Trump’s chaotic actions, firms are fraught with uncertainty and are therefore cautious about expanding and hiring. We’ve seen this in both the diminished hiring rate, which is down from about 30% in early ‘22 to 25% today, and the increase in “continuing claims” (people stuck on unemployment insurance).

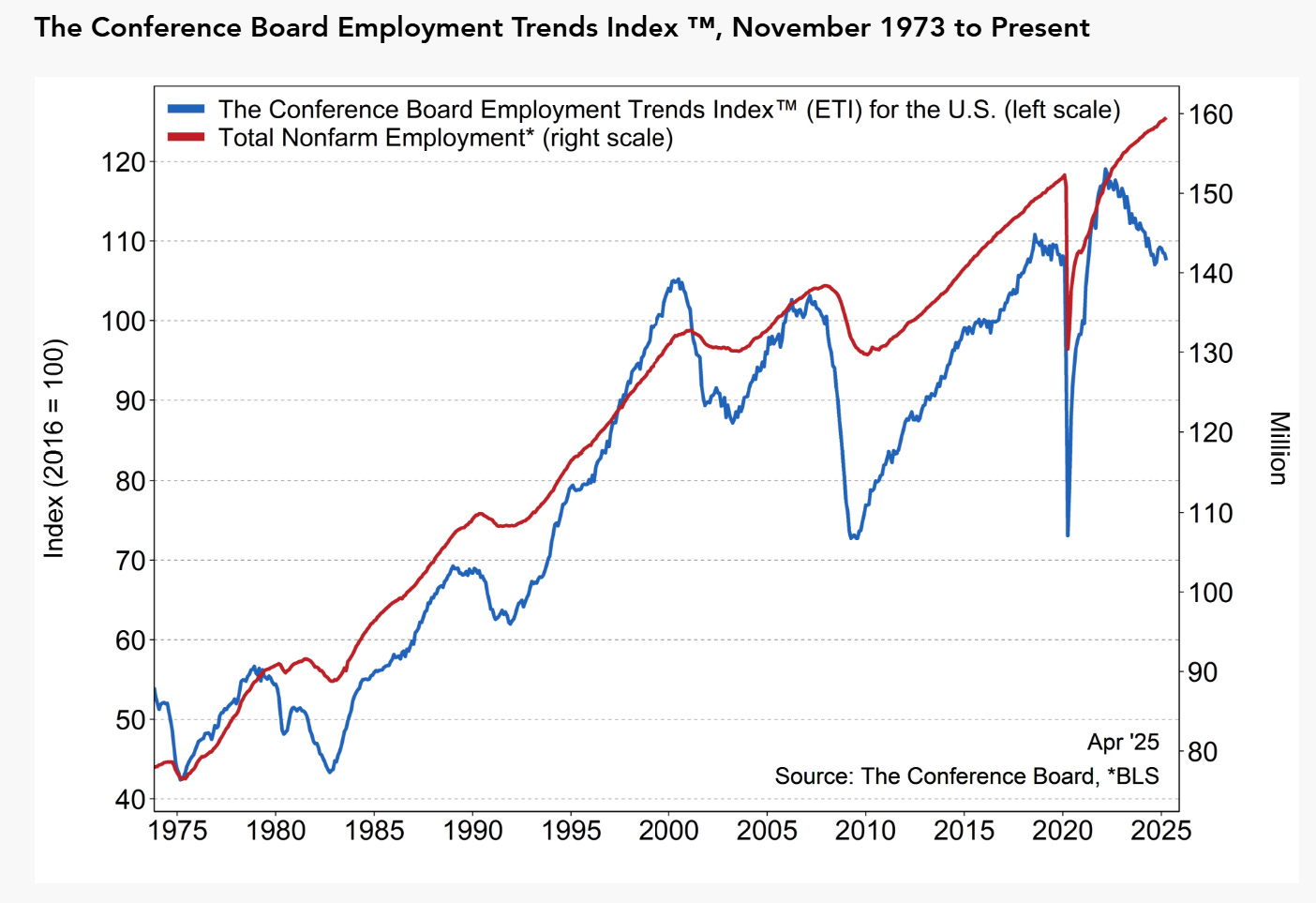

This dynamic has not gone unnoticed by job seekers. The recent Conference Board employment trends index (the figure doesn’t include this AMs data) measures both soft (people saying jobs are “hard to get,” a share that’s been climbing) and hard indicators (UI, job openings, et al). It’s heading south, even as payrolls continue to climb, opening an unusual gap in the series.

In other words, we’re all on shpilkes re two of the most important variables in peoples’ economic lives: prices and jobs. We expect the trade war to negatively impact both, and the anecdotes are flowing. But anecdote not equal to data.

For now, jobs, inflation, GDP growth (once you take out distortionary imports and inventories) all look good. But, while I’d truly like to wrong about this, it is highly unlikely that the economy and the people in it can escape unscathed from Trump’s trade and budget policies. Just what kind of scathing we’re in for is yet to be seen.

And yet, the Market is eating this report up like starving rats. The administration and the media show the huge day on Wall Street and claim "All is Well !!. Nothing to worry about, here." Are they are whistling by the graveyard, but don't know it yet?

We live in dicey times.

How much of the NFP report comes from imputations? A fair chunk compared to the halcyon days of the first few post WW2 decades. Some of this filters noise from the signal and improves analysis at the cost of catching turns.

You know better than I about the perils in seeing any month's deviation as a SIGNAL.

But, how many more changes since Trump came into office?

https://www.bls.gov/cpi/notices/2025/collection-reduction.htm

I wonder if Gene Ludwig will need to revise his upcoming "The Mismeasurement of America" sooner than expected given the Trump assault?