In the Biden CEA, almost every data note we wrote for President Biden ended with a sentence about not over-torquing on one-month’s result. Whether it’s an upside or downside surprise, “high-frequency” (monthly, weekly, even quarterly) data points can jump around for all sorts of reasons. Thus, to pull signal from noise, it takes more than a data point or two (this has important implications for Federal Reserve monetary policy which I’ll get back to in a sec).

In other words, the bar is high for a data-cautious person like me to say the following: we now have enough data to clearly assign the decline in consumer confidence and the rise in consumers’ inflation expectations on the Trump administration’s tariff policies.

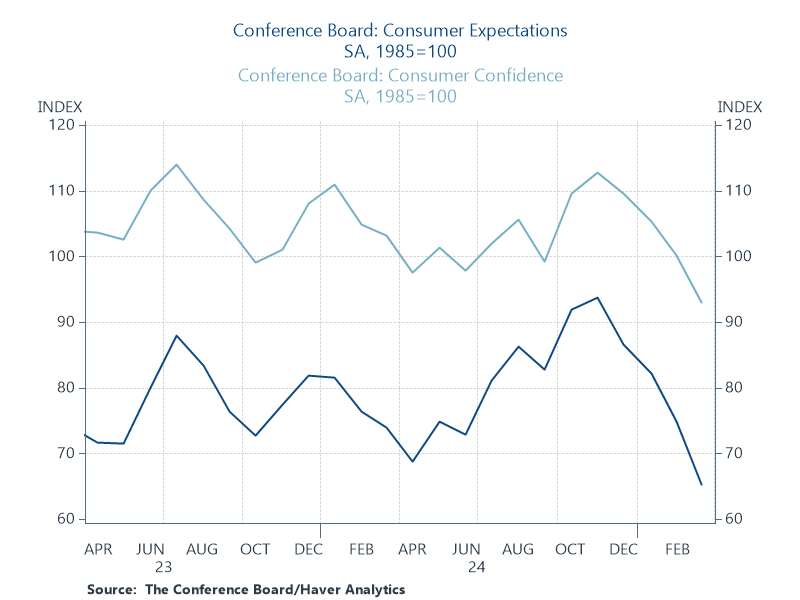

Yesterday’s Conference Board data showed that March marked the fourth consecutive month of falling consumer confidence, now at a 4-year low. Consumers’ expectations about the future (the darker line below) hit a 12-year low.

The Conference Board reported the following:

Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low. Meanwhile, consumers’ optimism about future income—which had held up quite strongly in the past few months—largely vanished, suggesting worries about the economy and labor market have started to spread into consumers’ assessments of their personal situations.

I’ve highlighted a similar decline in the University of Michigan Consumer Sentiment survey as well as business surveys, including a large drop in small business’s plans to expand, a function of highly elevated uncertainty about where things are headed tariff-wise. And it’s not just tariffs. The DOGE actions and even Signalgate reflect a level of incompetence in the highest places which undermines consumer, business, and investor confidence.

Inflation expectations have also trended up in the survey data, which is consistent with polling data showing that consumers correctly recognize that tariffs are a tax on imports and will raise their costs. The two UMich series below are somewhat biased up by political affiliation and a change to their survey methods, but the top line below, from the Conference Board (same source as the first figure) shows a similar spike in near-term inflation expectations.

However, inflationary expectations based on financial market indicators, like how much of a premium against future inflation borrowers have to pay lenders, are still pretty low and stable, particular at longer time horizons (likely reflecting that even if they raise a bunch of tariffs and then stop, that’s a one-time hit to the price level, not a source of ongoing inflationary pressure). In other words, we can discern that consumers are worried about the impact of tariffs on prices, but we cannot yet discern whether people’s longer-term expectations about where inflation is headed have become “un-anchored.”

Okay, what does this all mean??

First, for regular folks and for the real economy—jobs, growth, wages—it’s not good but it’s also too soon to know how all this negativity is impacting peoples’ economic activity. We’ve had years of bad vibes and strong data, so you just can’t jump from one to the other.

However, my gut—which is both ample and cautious—has me worried. While econ-vibes have been glum for years, a) they were pretty steadily improving, and b) they weren’t so sharply and uniformly negative. Team Trump has elevated uncertainty and pessimism among consumers, but also businesses and markets, the latter of which go up and down like a yoyo based on the latest tariff news.

It’s one thing to write about tariff uncertainty. If you want to see it in front of your own eyes, you’ve got to click through this WaPo graphic. How could any business with any connection to external trade plan what to do next in this environment?

Which raises the question of if and how quickly all this could change. I believe that if Trump just declared victory on tariffs today, cancelled “Liberation Day” (that’s what these weirdos call April 2, the next time they plan to raise a bunch of tariffs…or not), and declared they’re moving on to all-tax-cuts-all-the-time, markets would soar and a lot of this negativity would reverse, at least until the next own-goal kick.

But I don’t think they’re likely to do that. In fact, Goldman Sachs research team’s base case is that “Liberation Day” (when consumers are finally liberated from paying less for imports) delivers something like 10 percentage points of a higher effective tariff rate (the tax rate weighted by the relevant imports) with a risk scenario of 15 points. That maps onto 1-1.5% higher inflation, meaning instead of 2.5%, it 3.5 or 4%.

Finally, a note on the Fed re two points raised above. (Remember, folks: I couldn’t say “boo” about the Fed for 4-years, so you must indulge me.) First, on the data signal-to-noise point above, Chair Powell and the Fed always say that when it comes to interest rate decisions, they’re always data driven, which is very much as it should be. But what they mean—and this is very important to hair-trigger market investors—is not that they’re data-point driven, but that they’re data-trend driven. When markets fail to grasp this distinction, it can lead to a lot unnecessary volatility.

Second, should the Fed act on potentially rising inflationary expectations, as in being more cautious about rate cuts? Not yet, and especially not if growth slows. Though if it were me, I’d be a bit less dismissive of the survey evidence. Even if it’s not flashing red re de-anchoring inflationary expectations, it’s still saying something important about where folks are at in an otherwise solid economy that being battered about by reckless, incautious, and very much non-data-driven policy makers.

Trump's election in 1916 and then his re-election last year strained my confidence in voters' judgment. The consumer expectation plots are sort of reassuring that consumers are aware at least when their pockets are being picked.

Glad you can say more now that you're on the outside but I would strongly prefer that you still be on the inside.