Data_Note: CPI comes in cooler than expected; UI claims fine; Trump's pivot (not fine)

The tariffs aren't in here yet. But they will be.

Meanwhile, back at the real economy…

It’s nice to take a pause from tariff lurching (I speak to the latest on this sh—show below) and focus on a good, old-fashioned data report. This morning, we got the Consumer Price Index for March and the latest Unemployment Insurance claims.

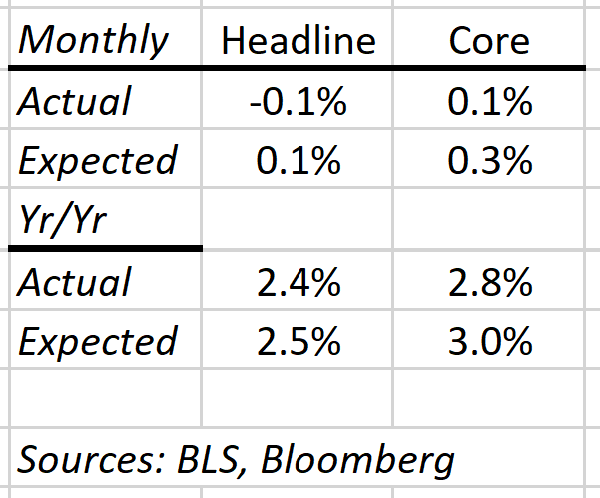

The CPI came in cooler than expected in March, as shown in the table below.

The monthly headline rate fell slightly and was up 2.4% over the year; the core index, which leaves out the more volatile energy and food costs to get a clearer signal take on underlying price pressures, also came in softer than expected, up 0.1% for the month and 2.8% for the year.

If you’re thinking: “Wait up! I thought all these tariffs were going to trigger higher inflation?!” I hear you, but it’s just too early to see those effects. As you’ll see, sharply falling energy prices played a big role in today’s report (and the tariffs mostly exclude energy), and while some truly hefty tariffs were in place in March—10% base tariff, 25% steel/aluminum (which, because they’re inputs, wouldn’t show up directly in this consumer price report), 25% autos excluding some Mex/Can imports—they’re not showing up in this report but, if they stay on, we should expect them in later reports.

As noted, falling energy prices in March played an important role in that headline miss. Gas prices fell very sharply, down 6.3% for the month on the heels of a 1% decline in Feb. A combination of weaker global demand and more expected supply for oil is behind the slide. Energy prices find their way into the core as well, through, for example, airfares, which were down a large 5.3% in March after falling 4% in February.

But energy was far from the only contributor to this cooler-than-expected report. Car insurance prices have been on a nasty streak, but were unexpectedly down 0.8% over the month, though still up 7.5% over the year. Tariff watchers were also worried about used cars (as price pressures on new cars would push buyers to the used market), but that too was down, by 0.8% over the month. Still too soon to see tariff-induced pressures in that space.

One aggregate category that I like to track, in no small part because the Fed likes to track it, is core services ex-housing. At 2.9% in March, it was down to its lowest yearly rate since ‘21. I need to dig in to what’s driving this. If it’s weakening service demand from spooked consumers, as some anecdotes have maintained, that’s obviously concerning. But if it’s settling back into more normal, pre-pandemic rates, that will be very helpful to inflation normalization.

When inflation comes in low like this, real earnings get a nice pop, and that’s what happened in March, with real hourly earnings up about 1.5% for both all and middle-wage workers.

So, slightly lower prices in March, cheaper gas, real earnings up, and that’s all on the back of a solid March jobs report. In other words, the hard data is still a lot better than the soft (survey) data, the markets, the rising recession probabilities (even post Trump cave), and the well-founded, pervasive sense of alarm regarding the depth of incompetency among our leaders. I don’t believe this dichotomy can hold, but based on these data, it did so in March.

UI Claims

Initial claims ticked up slightly but the smoother 4-week average was flat. Continuing claims were down 43,000 (4-week, flat), and both initial and continuing claims ticked down for federal workers. Both indicators are slightly elevated relative to a year ago for federal workers, but still at low levels.

In other words, we’re still not seeing much at all by way of labor-market layoffs, and while I understand and share the rising worries about a slowdown, the absence of layoffs—at least for now—remains an important indicator against that.

The Tariff Mess

As you know, Trump backed down yesterday on a big part of his tariff agenda (the “reciprocal” tariffs), spooked by the markets, especially the turmoil in bond markets. The latter is a particularly dangerous market to screw around with when your servicing $27 trillion in debt such that 1 point on your interest rate means $270 billion in added debt service.

None of this is unexpected, and you can read much analysis if that’s your thing. I did this AM and was again struck by the amateur-hour quality of this team, contradicting each other in real time, trolling each other on twitter, Bessent saying that this was his strategy all along only to be contradicted by Trump himself, who honestly just acknowledged it was getting too hot in the kitchen.

All of this is, demonstrably, bad for business, and while the 90-day pause is better than nothing, we’re nowhere near out of the woods.

Some are arguing the new effective tariff rate is still just as high as it was, based on some (more complicated) version of this calculation:

0.13 * 125% + 0.87 * 10% = 26%

That’s an import-weighed average, with 13% of China imports and 1 - 0.13 of all our other trading partners. But, IF (that’s a big if) the China tariffs stick, that 0.13 weight goes down. If it falls by half, the effective rate is a still high 17.5%; if it goes way down, e.g., 3%, the rate fall to around 13%.

This is all just fun with numbers, but the broader point is I would discount the 26% rate. Nobody knows what a 125% tariff on China could possibly mean in economic-impact terms, and, given the policy volatility of the moment, I wouldn’t waste too many brain cells noodling over it, other than concluding that it’s bad policy being implemented by a chaotic team following the whims of a volatile president motivated by, in his own words, “instinct” as opposed to facts.

And I do not thrust those instincts.

These good hard data feel like when the sucky basketball player hits a 3 pointer. Then all of the sudden he believes he is Stephen Curry and starts bricking 3 balls like crazy.

Elon Musk's Tesla cannot compete w China's EVs.

125% makes sense in that context.

https://restofworld.org/2025/byd-beats-tesla-on-price/

oops, make that 145%

Q.E.D.

https://www.cnbc.com/2025/04/10/china-trump-tariffs-live-updates.html