Inflation came up hotter-than-expected this morning, with the January CPI up 0.5% overall and 0.4% for the core (sans food, energy) against expectations for 0.3% on both. On a yearly basis, the core is up 3.3% (exp: 3.1%) and headline was up 3% (exp: 2.9%).

I’ll need to dig into the details later, but I’m not seeing anything, like some conspicuous outlier, that would allow one to wave this off. Inflation is not going gently into that good night.

A few of the pressure points:

Groceries were up 0.5%, their biggest monthly jump in two years, and it ain’t just eggs, though they’re spiking. “The index for meats, poultry, fish, and eggs rose 1.9 percent over the month, as the index for eggs increased 15.2 percent. This was the largest increase in the eggs index since June 2015 and it accounted for about two thirds of the total monthly food at home increase.” I can hear a lot of shoppers saying “Un oeuf is un oeuf.”

Housing wasn’t bad, up 0.3% for both rent and OER (the BLS imputed measure for owned housing inflation, called “owner equivalent rent”) and lodging away from home (mostly hotels) was up at 1.4% in January.

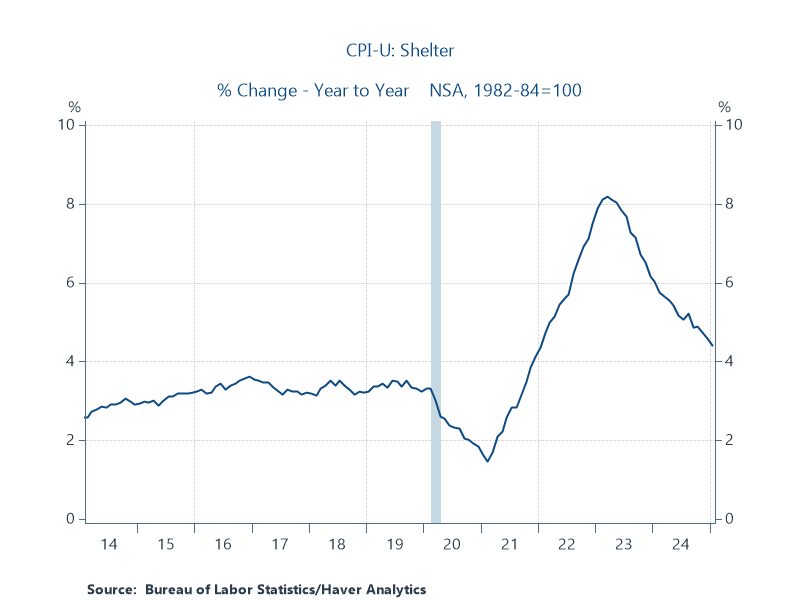

On a yearly basis, shelter, which gets a heavy weight of 35% in the CPI, was up 4.4%. It’s coming down, as you see, but is still elevated relative to pre-pandemic.

Transportation services spiked at 1.8% for the month, bumped up by both airfares (1.2%) and car insurance (2%).

Goldman Sachs analysts (sorry, paywall) make the following point re car insurance, which is up almost 12% yr/yr:

Higher car prices, repair costs, and medical and litigation costs have all put pressure on insurance companies to raise prices, but premiums have been passed onto consumers with a long lag in part because insurers have to negotiate price increases with state regulators.

Real hourly earnings were flat for the month, but up a solid 1% yr/yr.

Markets reacted badly to the report, with bond rates spiking (10-yr up 11 bps at 9:30am) and the Dow opening down 450 points.

There are two consequential revisions to today’s CPI data: seasonal factors and consumer weights. Updating the seasonal adjusters typically smooths out some of the outliers in the series, as you can kinda see below, but the main thing you see is accelerating prices.

On a yr/yr basis, we don’t see core acceleration, an important fact for the Fed. But neither do we see continued disinflation back to target.

What does it all mean? One month does not a new trend make. Outliers—expectations misses to either side—can and do revert. But all that said, this report should be a warning to the Trump administration to be far less cavalier about inflationary policies, especially tariffs, but also large, deficit-financed tax cuts. As I’ve stressed before, at this point, they’re not just fooling around with inflation that is struggling more than I’d like to get back to target. They’re potentially messing with inflationary expectations. That critical variable is “well-anchored” for now, at least at longer time-spans, but enough chaos could change that.

Finally, I hate to even say it, but there’s always a risk with these folks that if they don’t like the data, they’ll go after the agencies producing the data. I know the zone is flooded, but this is something that we need to ready to freak-the-hell out about.

Speaking of seasonal factors, the view from my kitchen this AM:

"Finally, I hate to even say it, but there’s always a risk with these folks that if they don’t like the data, they’ll go after the agencies producing the data. I know the zone is flooded, but this is something that we need to ready to freak-the-hell out about."

I read the entire piece because Paul recommended it. In the back of my mind was exactly this point that these guys will just change the data.

Many decades ago, when I was in the US Public Health Service working for the Environmental Protection Agency, there was nothing we could do when a newly elected city official moved an air quality sampling site from a polluted area of his/her city to a clean area. In today's climate, it feels like it's only a matter of time before Federal agencies are being told by the Executive Branch what to report as facts.

Here's why I've been reading your takes on the economy for many, many years, originally becoming a true believer via your blogs from your pre-policy making years. I've found you and Dr. Krugman to be the two best truth tellers, with clarity, that can be found.

I couldn't be happier to have found you again, and look forward to reading this substack as long as it available with the hope that it's available throughout the current administrations attacks on the truth and those who tell it.

Thanks, Jared.