Data_Note: Did you know that real consumer spending this year is up only...[see below]?

An important, if somewhat head-scratchy, data point that may well reflect Trumpian policy and chaos.

Enjoyed joining The Weekend team at MSNBC this AM (Jonathan Capehart and Eugene Daniels) to talk tariffs, tariff deals, and the US economy (also enjoyed hearing sage points from Congressman Gabe Amo, who, IMHO, gets it!; I’m not seeing a link to our segment, but if you go here, you should see it).

At one point in the discussion, I noted that real consumer spending so far this year, i.e., Dec24-May25, is up…0%. It’s actually down 0.2%, but easier on TV to just call that flat. That’s a pretty remarkable and under-reported number, especially given how important this growth channel has been to the ongoing economic expansion. Here’s the data, with a bit more commentary on the other side.

These are 5-month changes since 2000:

Source: BEA, 2020-21 omitted because they distort the y-axis: ‘20: -10%, ‘21: +5%

I omitted the pandemic years (see figure note) because they’re so extreme that they mess up the y-axis, but the most recent tick down is unusual outside of recessions. And, to be clear, I really don’t think we’re in a recession, not with unemployment at 4.1% and layoffs (and initial UI claims) still not even flashing yellow, much less red.

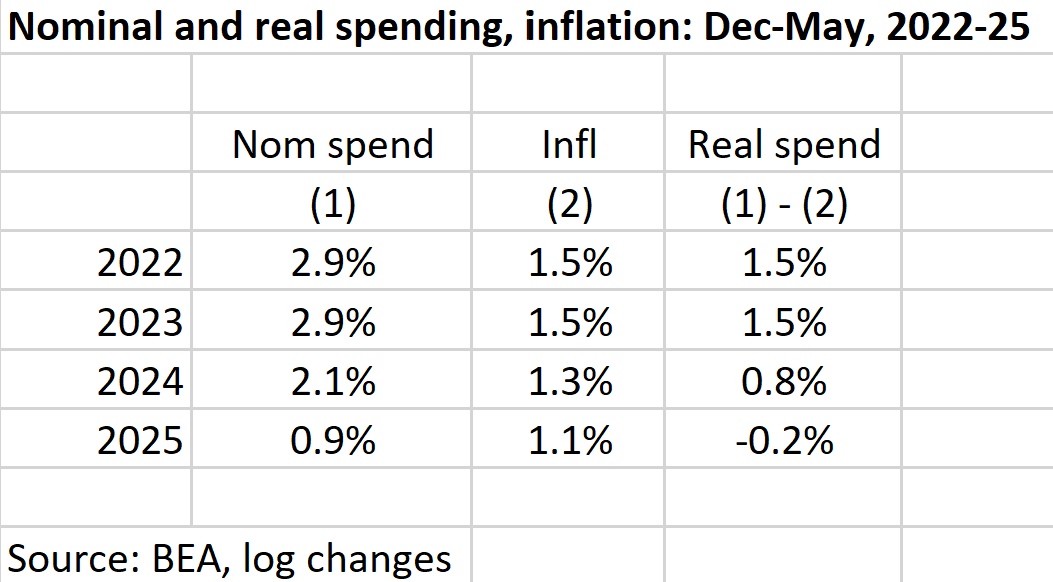

Since the above changes are real (inflation-adjusted) we can decompose them into nominal growth and inflation, as in the table below.

If you were thinking inflation explains the ‘25 result, it doesn’t. To the contrary, Dec-May ‘25 inflation was slower than the previous Dec’s-May’s. The culprit is much slower nominal spending, or if you prefer, consumer demand.

Looking at the broad sectors, real spending on both goods and services has been sagging. Goods is jumpy but services are smooth, they’re 2x the size of goods, and they’ve been trending down (again, on a 5-month, Dec-May basis). Nor do services easily fit into a tariff story.

So, what is going on here? The job market is still pretty solid, and that’s long been a key factor supporting real consumer spending. There are those who say the labor market isn’t as strong as it looks and that large, negative revisions are forthcoming. Maybe so, but I personally have been burned by such expectations in the past and am therefore cautious about leaning too far into it.

I have two potential explanations. First, it’s just a data blip and will shortly bounce back. In support of that hypothesis, tariff-induced behavior has been afoot, and we know that it has been distorting other key variables, including GDP. OTOH, five months isn’t a durable trend, but neither is it a blip. Also, as noted, while services are not immune to tariffs (e.g., restaurants buying imported food), they’re a lot less exposed than goods.

So, I have more faith in my second explanation: households are just downright nervous about Trumpian policies, from tariffs, to forced and often illegal deportations, to the highly unpopular budget bill they just jammed down everybody’s throat, to the daily chaos and BS (e.g., if you try to listen to their word salad about all the amazing trade deals they’re enacting before their 7/9 deadline, you will quickly get a very bad headache).

All that is bad for what Keynes called “animal spirits,” what many call consumer and business confidence, and what you might think of these days as “WTF is happening to our country!”

I not only agree with you, but I submit that this kind of caution on the part of the consumer is rational.

Just as businesses can't make decisions about long-term investments right now because of that uncertainty, consumers are in a similar situation situation

WTF as an utterance is probably the only thing growing in Trump 2.0 other than the holdings of the Grifter in Chief and his family. On Friday the GOP essentially uttered the immortal words of Marie Antoinette "Let them eat cake". Let's see how this chapter ends?