Data_Note: February's CPI comes in cooler than expected.

It's a welcome 1-month return to the disinflation we were seeing earlier last year. But the tariffs aren't in here yet.

The Consumer Price Index (CPI) rose 0.2% last month, and is up 2.8% over the past year, below expectations for 0.3% and 2.9%. The core CPI, which leaves out jumpier food and gas prices to get a cleaner underlying signal of trend inflation, was up 0.2% monthly and 3.1% yearly, also a tick below expectations.

Both these topline numbers and some of the under-the-hood components discussed below suggest that inflation cooled somewhat in February, reflecting neither the tariff policy whiplash nor any obvious tariff price effects. Of course, it’s early to expect any policy impacts on inflation, but this report looks more like some the disinflationary reports we were seeing from ’23 through the first half of last year before progress stalled.

Which components contributed to February’s cooler print?

--Gas prices were down by 1% and grocery prices were flat after jumping 0.5% in January. Eggs were up 10.4% over the month (down from 15.2% in Jan) and a cray-cray 59% over the past year.

--Car prices came in softer than expected, with new car inflation at -0.1% and used vehicles at 0.9%, down from 2.2% in Jan.

--The closely-watched core services ex-housing component also came in softer than expected, up 0.22% for the month (versus 0.32% expected). This category carries a hefty 35% weight in the core index and has been one of the stickier parts of the index in recent years.

--Airplane tickets took a big and unexpected step down in February, down 4% for the month. Not only is this a noisy series, but it’s been a lot noisier since the pandemic, as shown in the figure, contributing to bad consumer vibes. People really don’t like higher prices, of course, but they also don’t like really jumpy prices.

--Housing (aka “shelter”) was up 0.3% last month, about where it’s been in the past few months. The figure below shows the gradual disinflation in both rents and so-called “owner-equivalent rents”—the BLS measure of owned-home inflation—but both of these rates still remain above their pre-pandemic pace.

--Car insurance inflation has been a consistent source of pressure lately, but it came in softer in Feb, up 0.3%, down from 2% in Jan, though on a yearly basis, it’s still up 11.1%. Much of this appears to be catch-up inflation. Analysts at Goldman Sachs Research:

Higher car prices, repair costs, and medical and litigation costs have all put pressure on insurance companies to raise prices, but premiums have been passed onto consumers with a long lag in part because insurers have to negotiate price increases with state regulators.

That said, Feb’s result could signal—too soon to be sure—that the lagged catch-up is winding down.

—Real hourly earnings were up a healthy 1.2 and 1.3 percent over the past year for all private workers and mid/lower wage workers. That’s a solid pace of real wage gains that’s helping to support consumer spending.

How does this report relate to the daily, market-disrupting chaos emanating from the Trump administration? It doesn’t, really, as it’s too soon to see much yet. In fact, one might worry that this more-benign-than-expected print would embolden the merchants of chaos to triple down on their unfortunate agenda. And that, I’m highly confident, will make us long for reports like this one.

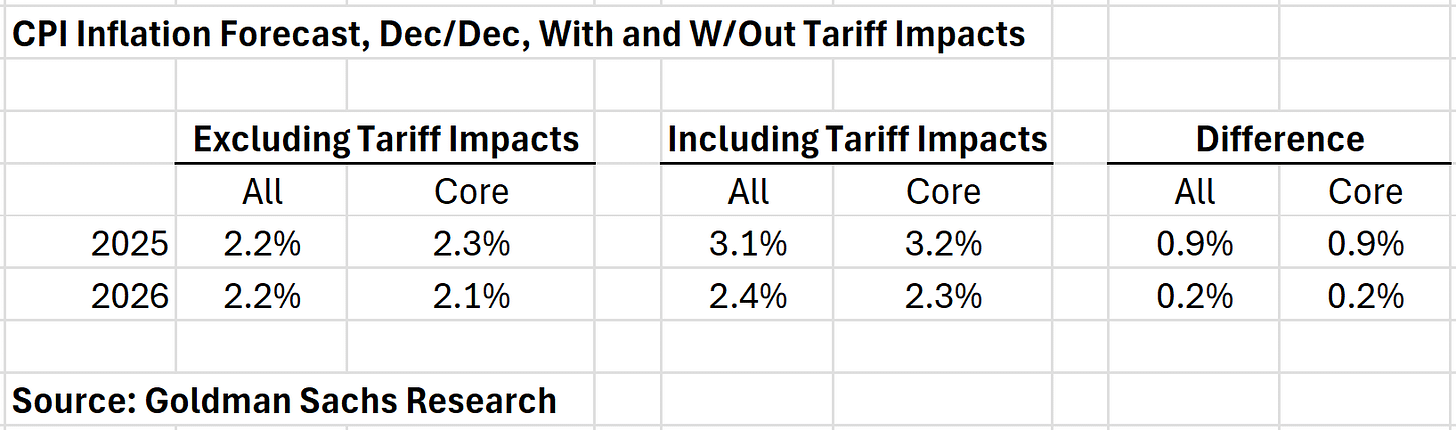

The table below shows GS’s latest forecast of the impact of the tariffs on yr/yr inflation this year and next. They expect the tariffs to add almost a point to inflation in ’25, an effect that lessens but doesn’t disappear in ’26. If they’re right—and of course uncertainty abounds in this space—absent the own-goal kick of sweeping tariffs, inflation would be a glide path back down to its target from the Fed’s perspective, and pre-pandemic levels from consumers’ perspective.

What somewhat surprises me is that markets worry about the impact of tariffs and immigration (mix between higher short term inflation and a growth hit) but not about the ‘coup’. The latter challenges what is possibly the root cause of American success: Constitution, rule of law, belief in the scientific method and free markets/competition.

Wait for the Trump effect