Data_Note: I'm concerned about the CPI

It came in at expectations, but between the tariffs (which I think only get worse in this space), the housing supply shortage, and sticky service prices, my spidey sense is triggered.

The Consumer Price Index rose 0.3% last month and 2.7% on a yearly basis. Core CPI, which omits volatile food and energy costs in order to get a better sense of underlying price pressures rose 0.2% monthly and 2.9% yearly. These rates are roughly in line with what was expected (headline a touch above; core a touch below), but the report shows more inflation than May along with a bit of price heat in ways that a) pretty clearly reflect some tariff effects, ones I expect to grow clearer in coming months, and b) may therefore sustain the Fed’s wait-and-see posture (more on that below).

Re the tariffs, a quick tweet from Ernie Tedeschi noted that:

The impact of tariffs is becoming more salient. Apparel, which had seen cool inflation the last 2 months, grew 0.4% in June. Household furnishings grew 1%. Video & audio electronics grew 1.1%.

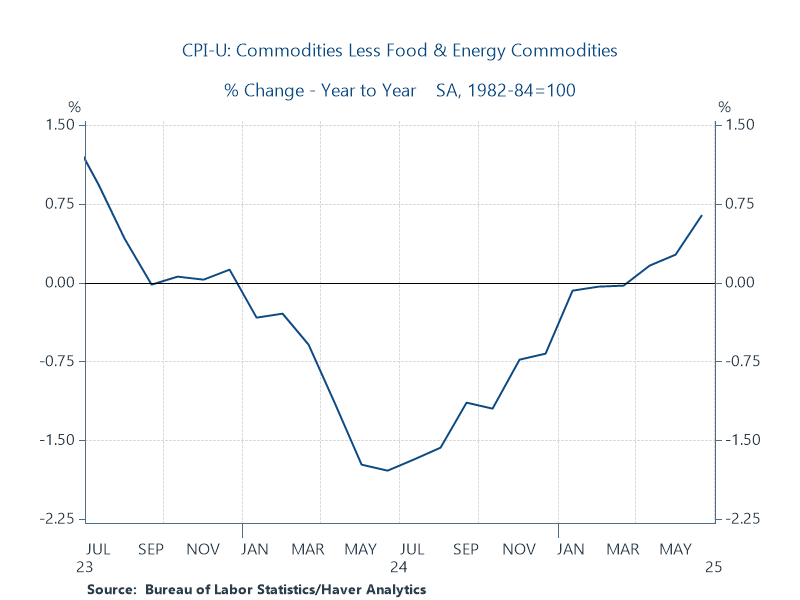

I’d add the broader commodities index is no longer the disinflationary helpmate it was in 2023 in that its yr/yr change broke zero in April, likely reflecting some consumer passthrough of import taxes on imported goods (Ernie also has great slides reflecting that effect).

This is a problem. In recent posts, I’ve been asserting that we’re starting to see the tip of the spear of consumer price passthrough for a least three reasons. First, the revenues collected from these import taxes is far, far above their usual levels, $28bn/month in June vs. one-fourth that amount pre-trade war. And those $ will not stay with the importing firms; some share will be passed forward. Second, importing firms front-ran the tariffs with inventory buildups, but drawdowns can only take so long. Similarly, firms are now confronting much more price sensitivity in their consumers, so they’ve sacrificed some profit margin. But that too is time-limited.

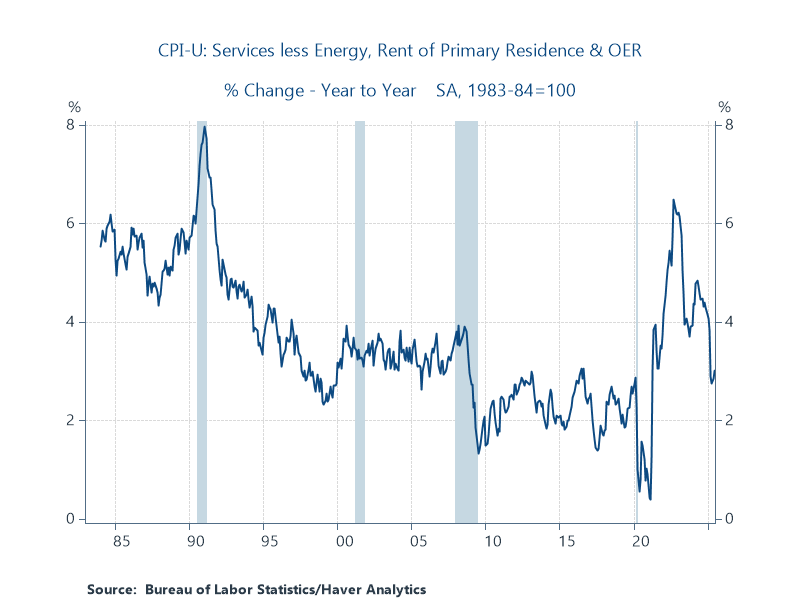

If core goods aren’t going to help bring down inflation as much as they did, how about core services, which are less directly hit by tariffs? Well, they’ve been sticky too. You can see the slight tick-up at the end of the series, to 3% yr/yr in June from 2.8% in May. That puts this component a point above its pre-tariff rate, 2010-2020, and closer to its rate in the previous decade.

That leaves housing (core inflation is comprised of core goods, core services, and housing), which, given our national shortage of affordable supply, relatively high mortgage rates, and therefore a moribund market, has settled in at around 4% yr/yr, a big notch above its pre-pandemic trend.

So, here’s my case, which I want to be careful not to overstate: CPI inflation has come down a great deal from its 9% peak in June of 2022, a peak that is emblazoned on my soul! But its return to the Fed’s target is sticky. One reason that is coming into focus is that tariffs, a problem which is, of course, totally avoidable. Another is sticky housing prices, both rent and owned homes, which comprise about a third of the overall index (>40% of the core). Core services have definitely come way off their peak too, but there’s still more pressure there then is comfortable for both consumers and the Fed.

The Fed, however, would like to believe that the tariffs, once they settle in, are, like any other tax, a one-time hit to the price level, not the growth rate, and that makes them more comfortable with rate cuts. But Trump won’t let them settle in, and that’s a problem for all of us, especially as their price effects are starting to show.

Thanks for the analysis.

I was checking through the energy components, noticed electricity (up 5.9% y/y) and thought about the soon to be cancelled solar/ev/battery tax credits and discontinued Inflation Reduction Act Capex.

The next energy crisis will be in electricity, and this, as you note, given China's awesome productive capacity in such, is totally avoidable.

Here's a price data point:

On 5/24/25 I paid $1399 for this range: https://www.homedepot.com/p/LG-6-3-cu-ft-Smart-Induction-Slide-In-Range-with-ProBake-Convection-Air-Fry-in-PrintProof-Stainless-Steel-LSIL6334FE/327604161

Current price is $1999. It was "on sale" both then and now. As an LG product it was probably made in Korea but in any case the price went up 43% in less than 60 days. Hard to know how much of that is just normal business and how much is related to tariffs, but 43% is significant.