Data_Note: PCE Inflation okay, but real spending takes a hit

One month does not change the strong spending trend, but neither can we ignore it. Also, housing (bad), UI claims (still okay).

Inflation as measured by the Personal Consumption Expenditure index came in as expected in January, with the overall and core measures both up 0.3% for the month and 2.5% (headline) and 2.6% (core) for the year. The core PCE is a key gauge for the Federal Reserve’s interest rate policy, and the January annual read of 2.6% was down from December’s 2.9%, so that’s welcome disinflation.

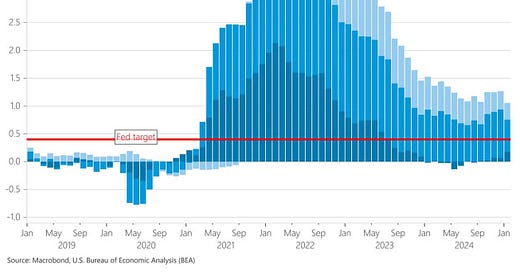

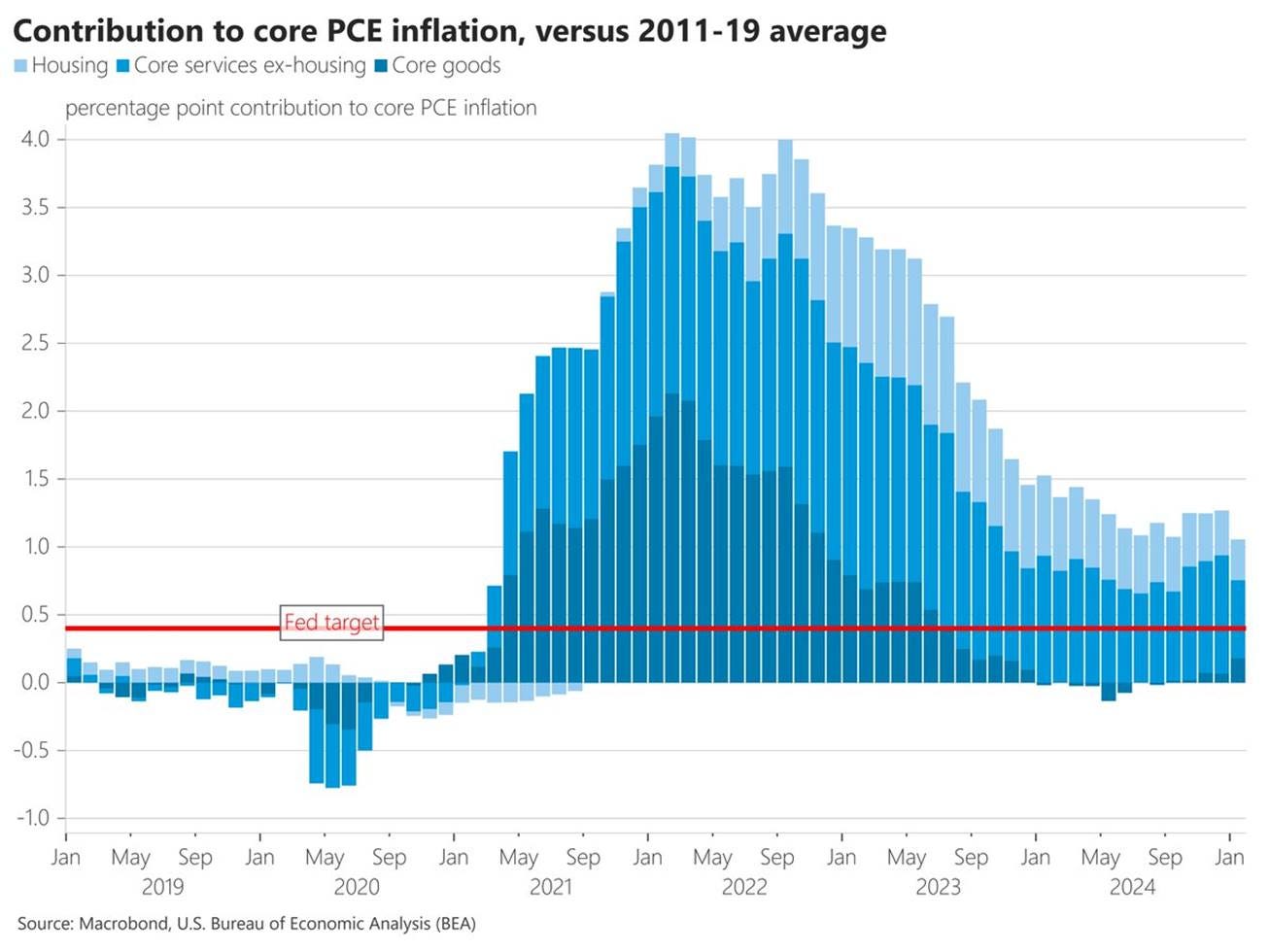

This figure from Nick Timiraos is key, imho, re where core PCE inflation is and where it might be going. It breaks the core down into its contributions from housing, services ex-housing, and core goods, all relative to the pre-pandemic average of 1.6%. Going back in time, it shows the remarkable inflationary shock from pre- to post-pandemic. Then, moving forward, we see that as goods supply and demand began to normalize, that component fell sharply. The other two, however—services and housing—remain elevated contributors. They came down sharply too, but they’re taking their damn time over the last mile. Note also—you have to squint to see it—that the goods contrition is picking up a touch. Not a big concern, and the direction of travel is still disinflationary, but it’s far from a straight line down back to target.

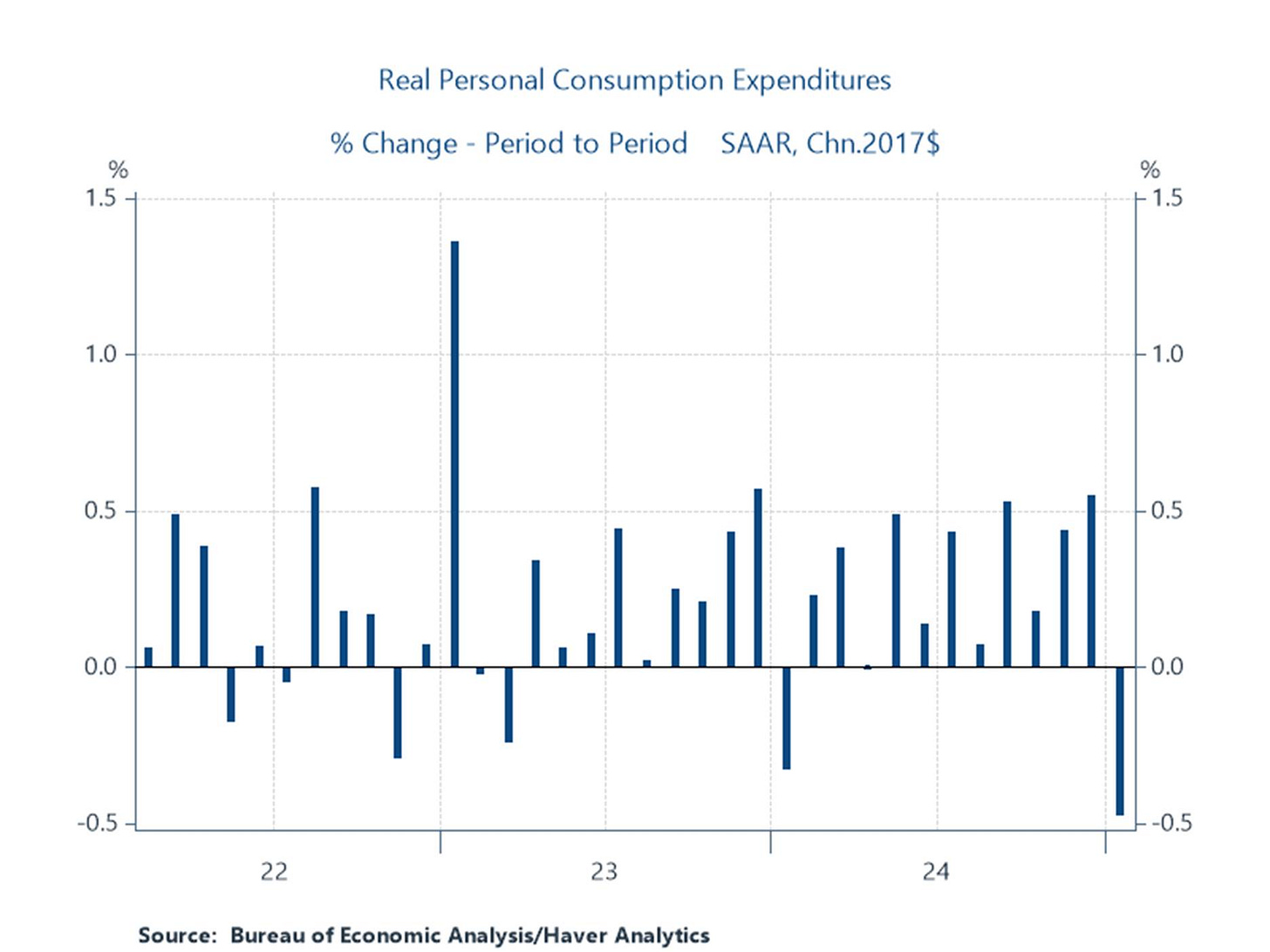

Given that inflation is doing what we all thought it would, I’m actually more focused on a bit of an outlier in this report. Real consumer spending fell, by 0.5%. As the figure shows, that happens—these are noisy, monthly data. But income grew more than expected in January and therefore, the savings rate spiked up from 3.5% to 4.6% (income – spending = savings).

We’d be mistaken to over-torque on this result. January was unusually cold, and that dampened economic activity in the month. But given that this decline is consistent with people’s widely expressed nervousness about the impact of tariffs on prices and chaos-induced uncertainty, we’d be equally mistaken to fully discount it.

Another week, more bad housing data

Virtually every data point, with one important exception, coming in on the US housing market is ugly and, in many cases, uglier than expected. New Home Sales fell -10.5% last month, partly due to unusually cold weather in January across the land. But it’s not just weather. It’s affordability: Over the past year, the median new home price was up 3.7% to $446,300, its highest level since late 2022.

I find the long-term view helpful when trying to understand the current housing market. Here are new home sales over time, showing the clear cyclical pattern, as well of the excesses and massive crash from the housing bubble in the first decade of the 2000s. What I’ve been stressing lately in these notes is the comparatively stark weakness of the current cycle. Even the bad old 1980s, with its own real estate bust, at least started out with the usual cyclical pattern.

The one glimmer of light in this space is the dip in the 30-year mortgage rate, which is down about 50 basis points over the past month, from 7.25% to 6.75% (the decline tracks that of the benchmark 10-year Treasury rate, also down about this much over the same period).

UI Claims: Still fine, but…hmmm

Initial UI claims, a noisy, weekly proxy for layoffs, popped up 22,000 last week to 242,000, about 20k above expectations. The smoother (and more reliable, signal-to-noise wise) 4-week average rose 8,500. The stock of folks on UI—continuing claims—was flat (down slightly for week; up slightly for the 4-week average).

The job market is still looking good. Both the monthly jobs reports and the UI claims reveal slower hiring, but not yet higher layoffs, which is keeping the unemployment rate in the low neighborhood around 4%. You just can’t really have a labor-market problem without layoffs.

Okay, but what about the DOGE? In fact, we should all be worried about their impact on each of the following:

--The disrupted lives of the people who they’re firing, both federal workers and contractors;

--The disruptions to government services, including Social Security, IRS, national parks, consumer protection, and much, much more;

--If enough gov’t and gov’t-adjacent layoffs are geographically concentrated, those areas will be hit with contractionary forces.

That’s it for this week’s Data_Note. I do not like that -0.5% on Jan real consumption. Not freaking out at all. But my data Spidey-sense is triggered.

[BTW, great line from Colbert re the recent spike in the biz uncertainty index: “can you ever really know where you are on the uncertainty index?”.]

Thanks Jared for this explanation. I worry Democrats may find themselves fighting the last battle. The conventional wisdom seem to be that Trump won the election because voters were mad about inflation and Trump promised to lower prices. Now when those voters discover Trump is not able to lower prices they will vote for Democrats. But MAGA followed the data. Biden was killing the economy with mandates. When inflation spiked to 9% that was Biden's fault. And when it dropped to 2.1% then "prices were too high". Tariffs and deportation and deficits may raise prices. But they may have other effects. Tariffs are a one time price increase and may not drive continued inflation. Deportations may be more show than reality. Trumps crazy could just drive economy into a tailspin without inflation.