Data_Note: Some Cracks Showing...Maybe.

Jobs, real compensation, and real consumer spending are still the big drivers. But there are some concerning signs.

[Sorry about the picture—it’s Friday, right?]

Two facts to start off this brief but important data note:

—First, the current expansion has long been driven by robust consumer spending (68% of our GDP). Coming out of the pandemic, it was fueled first by excess savings and fiscal support, then by full employment and real wage gains.

—There’s always too much noise in monthly data to reliably pull out a trend but it’s worse now. The aggressive frontrunning response of importing firms, and even some by households, to the tariffs is distorting key data reports.

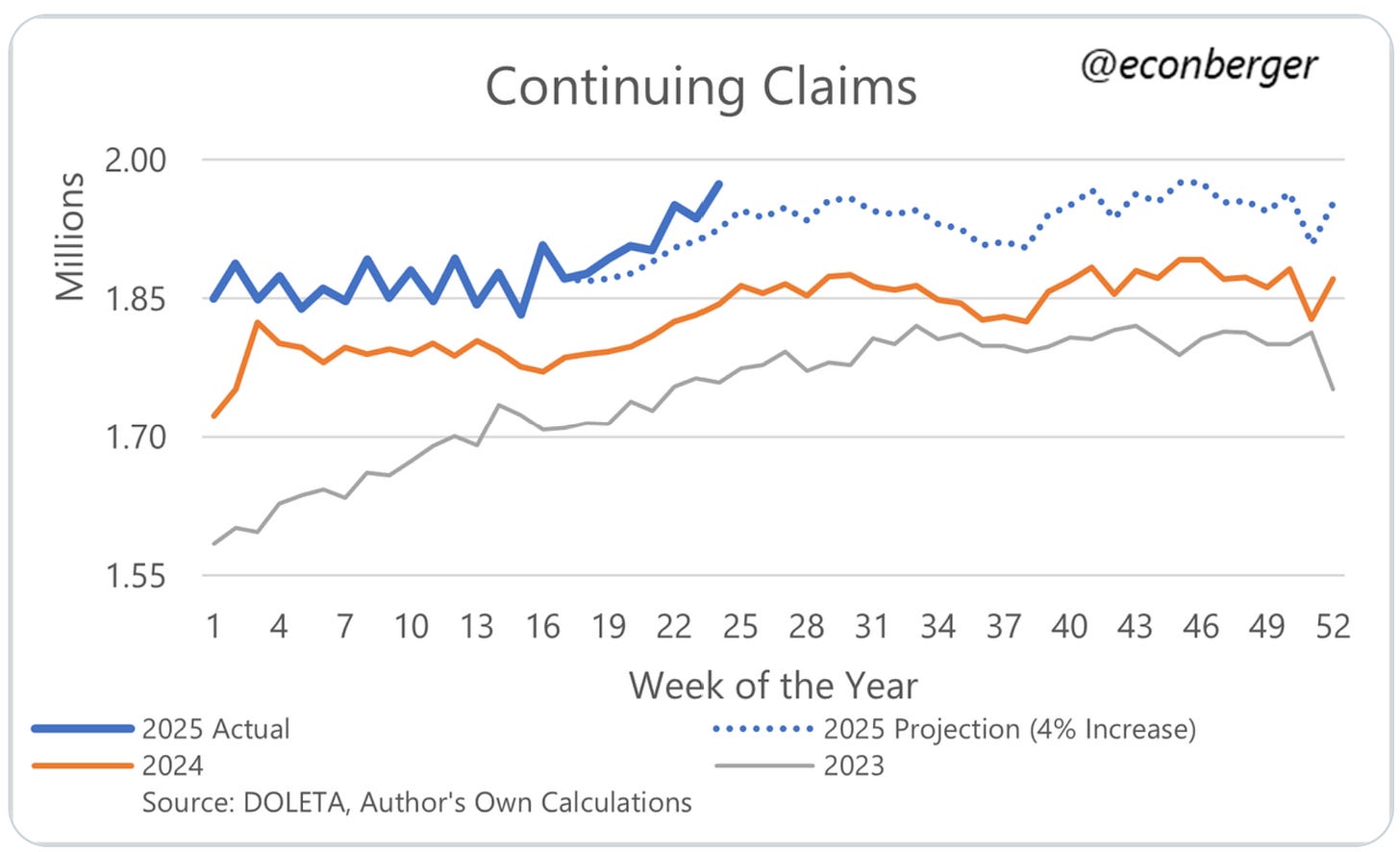

That said, I have two concerns. First, though the job market is still playing its key role described above, hiring has slowed even while layoffs remain low. Anecdotes of difficulty finding work, especially among young college graduates, abound, and the plural of anecdote is data (and, in fact, some suggestive data on this already exist). Continuing UI claims bumped up again this week, even as initial claims were fine; this is now a trend, and it’s consistent with this weak hiring story (thanks, as usual, to Guy Berger).

Without layoffs, and with the decent level of job creation we’ve had, the unemployment rate could still remain low, but this all comes down to whether consumer demand can remain strong, which brings me to my next point.

We’ve now seen a couple of hard data points showing weaker consumer spending. We learned this week that for Q1 of this year, real spending grew at just a 0.5% clip, the worst quarter since the pandemic recession. This AM, we learned that real spending in May fell slightly, by 0.3%.

But—you knew this was coming—caveats are required. We know that firms front-ran the tariffs, jacking up imports and distorting Q1 overall GDP (it fell 0.5%, real, but the underlying growth rate when you take of the import-spike effect was more in the 1.5-2 percent range). Well, some households did too, e.g., accelerating car purchases, meaning part of the 0.8% decline in goods spending last month was also a bounce-back effect.

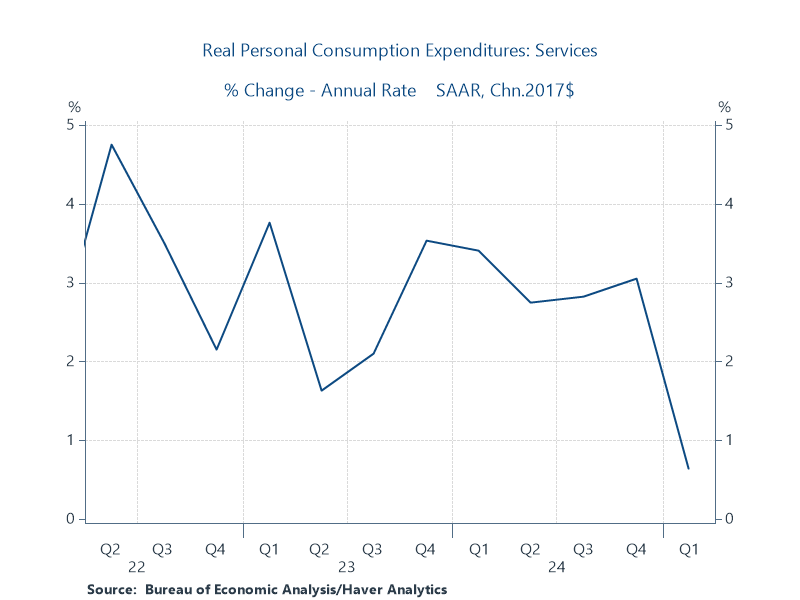

However, services aren’t picking up the slack: they were flat in May, and pretty damn meh in Q1 (figure below).

So, we’ve got both some labor market weakness and spending weakness, both of which could really hurt the expansion if weak hiring devolves into layoffs and these spending blips devolve into negative trends.

Does that mean it’s freakout time? Definitely not. Q2 GDP is going to bounce back from Q1, though we’ll need to get under the hood to take the temp of core GDP. Some indicators suggest slowing there as well, but down to levels that are still okay (one measure of core—real spending plus real investment sans inventories—was marked down from 3% to 1.9% in Q1).

But here’s the main reason why not to get too worried yet. The labor market is still generating real, aggregate compensation (AC) gains that are consistent with continued forward momentum. The figure below shows yearly growth in nominal AC, which is a useful measure in this context because it captures wages times employment. This means that even if real wages were flat—which they’re not; they’re growing north of 1%—this metric would rise due to job (really, hours-worked) gains. The other line in the figure in the yearly inflation growth rate. So, we want to see a nice, chubby gap between comp and inflation.

Which is what we see here in recent years, a gap that comports with pre-pandemic levels. That right there is enough to keep the macro economy moving forward.

At least, it would be if there wasn’t such a sh—show of terrible policy cascading down from the Trump admin. Here’s how one market analyst summarized a bunch of what I’ve just been saying:

"Consumers cut back on outlays last month, making fewer discretionary purchases as they grapple with softer labor market conditions, increased financial uncertainty and the onset of tariff-induced price increases," wrote EY-Parthenon senior economist Lydia Boussour in a note.

I’d add to this the angst being generated by the WBBE (Worst Budget Bill Ever), with states worried about losing significant revenue flows from the feds to support their economically vulnerable populations, investors worried about the impact of huge, new deficits on interest rates, and general uncertainty as large majorities grapple with the fact that these out-of-touch Rs are either a) clueless as to how unpopular the WBBE is, b) know that Trump wants it and that’s enough for them, c) doing their donors bidding for high-end tax cuts, or, most likely, some combo of all three.

If you want to throw in market angst due to Trump’s increasing threats to compromise Fed independence, I won’t stop you.

That’s what I’ve got for today. I do not need to tell my readers that I’ll be watching all of this very closely and will report all relevant wiggles and waggles as they come in.

Reading the headline of this article, I'm starting to think that perhaps we were wrong all the time, perhaps it was never "the economy, stupid".

First of all, Biden delivered a booming economy. Result? People voted for a fake businessman who bankrupted his own businesses six times rather than voting for the person best positioned to build on these economic successes, namely Biden's own VP.

Secondly, look at the booming economies of Hong Kong or Singapore. As neoliberals and also Peter Thiel often repeated: capitalism and democracy are incompatible. These more or less fascists states have great economies, and yet, no real freedom or prosperity for most of its citizens.

So perhaps, instead of hoping that the immoral and incompetent GOP will crash the economy (which their neofascist propaganda machine would undoubtedly manage to spin as caused by anyone BUT the GOP or Trump), we need to ask ourselves a very different question: what CULTURE does a society need for democracy and society as a whole to thrive?

Yuck!