Data_Note: Uncertaintly, Who Tariffs Hurt, Goods Spending

Mostly graphics as we await Lib Day reveal.

Am I the only one who thinks it’s weird that the White House is treating this whole tariff thing like a big, splashy reveal party?! This isn’t a game show, people! Generating needless uncertainty is bad economics, as are sweeping tariffs themselves. (I will say that, apart for battle plans, they’re surprisingly non-leaky.)

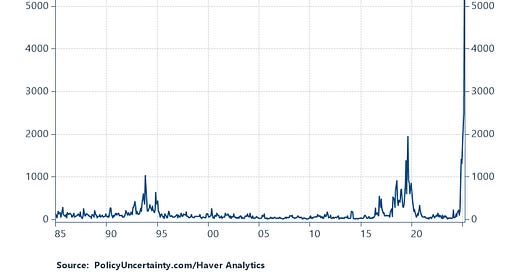

And trade policy uncertainty, measured here by PolicyUncertainty.com which tracks related words in media publications, is through the freakin’ roof!

To be clear, I don’t believe this gets resolved at 4pm ET today, when POTUS allegedly explains their plans, which are reported to be either reciprocal tariffs or a standard 15 or 20 percent across-the-board import-tax rate. The former supposedly signals a negotiating stance; the latter, just hard-core-anti-trade. But I wouldn’t read that much into such nuances. The policies are poorly thought through, not well understood by their purveyors, who are constantly lurching between rationales and even the plans themselves. I wouldn’t count on too much much clarity later.

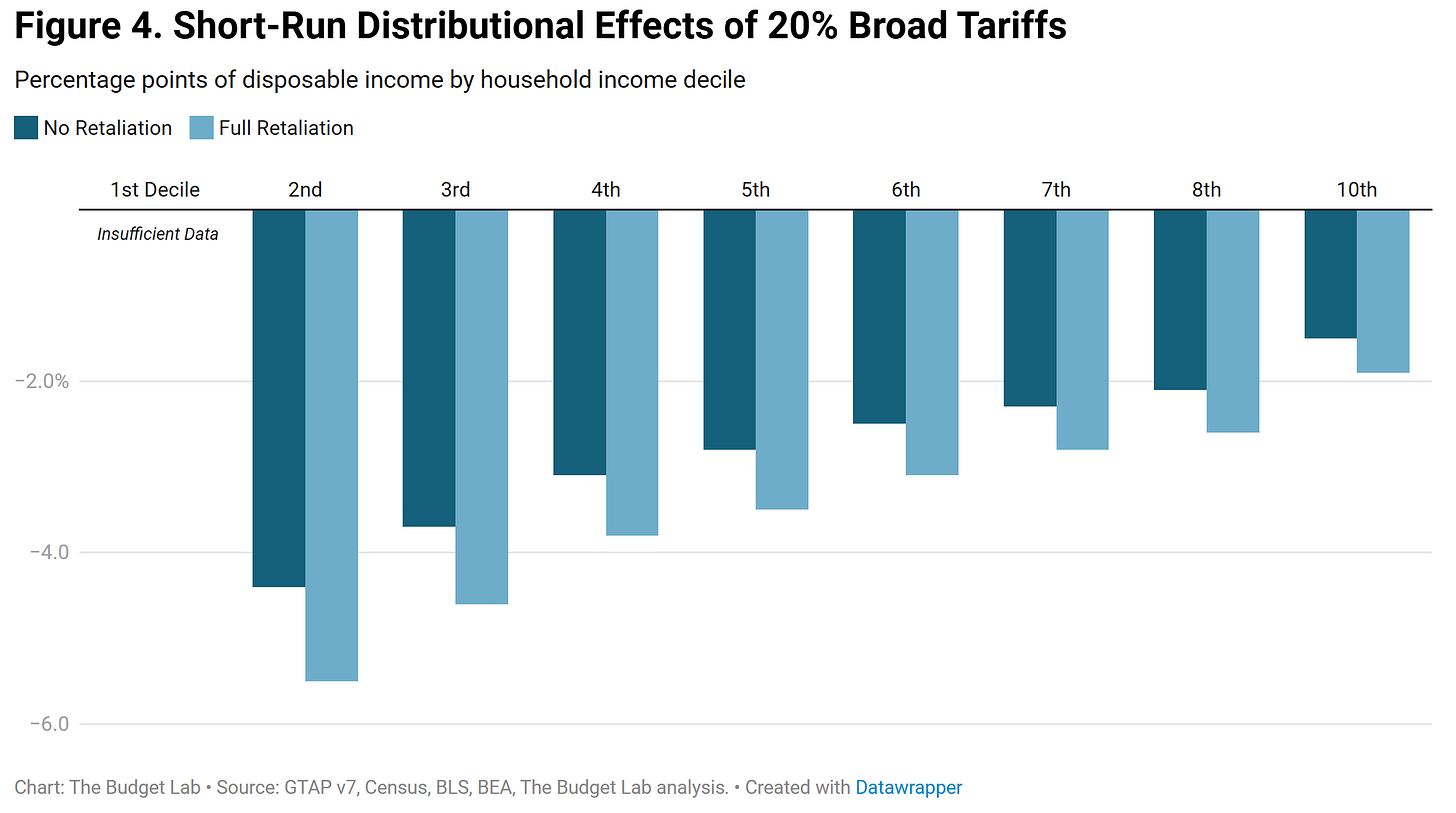

Next, two figures from the excellent Yale Budget Lab’s analysis of the 20% version.

First, this would take the country’s tariff rate back to at least the early 1900s. That, in itself, doesn’t tell anything re outcomes, but it does signal a huge disruption to a trade regime that’s persisted for decades. Again, that’s not a values’ statement. There are those, especially in the White House, who are clearly anxious to go there. But as I and many others have stress, you cannot unscramble this globalization omelet without generating real economic pain that falls disproportionately on the most vulnerable, as the next Budget Lab figure shows.

Equally importantly, as Dean and I explained, it’s not pain now, gain later. It’s pain now, full stop. There’s no reindustrialization on the other side of this rainbow.

I’ve written in recent days that, because of consumption patterns—low-income households buy more imports as a share of their spending—tariffs are a regressive tax. Here’s the evidence. Tariffs’ price effects reduce income by around 5% for low-inc HHs and <2% for high income.

Finally, I find this next one really interesting, as well as germane for this discussion. It’s an update of a CEA figure we used to track which plots spending on manufactured goods as a share of consumer spending. As economies advance, services expand relative to goods production, so the longer-term, downward sloping trend makes sense.

But when the pandemic hit and we couldn’t safely interact with services, this share spiked in a totally unprecedented way. We spent our unspent services dollars, as well as fiscal support, on stuff for the home office, exercise equipment, TVs, etc., much of which we import. This combination of strong demand for goods at a time when global supply chains were jammed by COVID was a key factor pushing up goods inflation at the time.

What’s interesting is that while this spending share is back to its pre-pandemic level, it’s still well above trend. Perhaps it’s just taking its time to get back there; restaurants and many other services price levels are still elevated, so maybe there’s more “normalization” to come in this series. But by now, there’s a chance that something rare in economics has occurred: a sharp, lasting shift in this aspect of consumer preferences.

If so, the tariffs, which are on goods imports, will bite even harder than historical models predict.

" ... This isn’t a game show ..."

No indeed. It is in fact a Clown Show. Please note that Trump's deranged psyche REQUIRES constant attention, constant limelight, constant reinforcement. There is no such thing as bad media coverage, as long it captures eyes and ears.

There will be no end to political, social, economic, and military catastrophes if that is what it takes to keep the spotlight focused on the Clown.

I am curious whether it is feasible to impose a tariff on services like software (downloaded, not on physical media), travel, insurance, video entertainment, etc.

Also, if Trump was to decide that tariffs wouldn't be applied to any country where the US has a trade surplus (in goods), then if Canada exported more oil to Asia (currently pipeline capacity constrained), then the US would have a trade surplus (although tourism is trending down sharply).