Implausible Growth Estimates

Growth effects from the big, ugly bill are likely to be a) close to zero, and b) swamped by the negative growth impacts of the tariffs.

As Tom Petty put it when asked whether growth effects from tax cuts for the rich would offset their costs, "Hey baby, there ain't no easy way out!"

I fully grant you that at a moment when the president is invoking insurrection where there is none, and summoning troops into an American city, not because they are needed but to generate the chaos that justifies his authoritarianism, implausible growth estimates seem pretty innocuous.

But resistance takes many forms and we all have our jobs to do.

Admin officials continue to argue that the BUBB (big, ugly budget bill) will generate more than enough growth to offset its trillions in mostly high-end tax cuts:

"If we get 3% growth, then that increases revenue by $4T, which is WAY more than the deficit increase that CBO estimates for the cost of the bill. So, this bill by itself is going to reduce the deficit…"

That’s beyond wishful thinking, for many good reasons.

No tax cut bill has ever generated anything like that amount of growth, and even studies that find the TCJA did boost investment are clear that it came nowhere near to offsetting the full cost of its deficit financing.

Most of the bill just extends current policy, and there’s no new fiscal boost in that. There is, however, large deficits scored against the baseline that assumes the tax cuts would expire.

The tariff regime pushes hard in the other direction.

That last point is important and underappreciated so let’s unpack it.

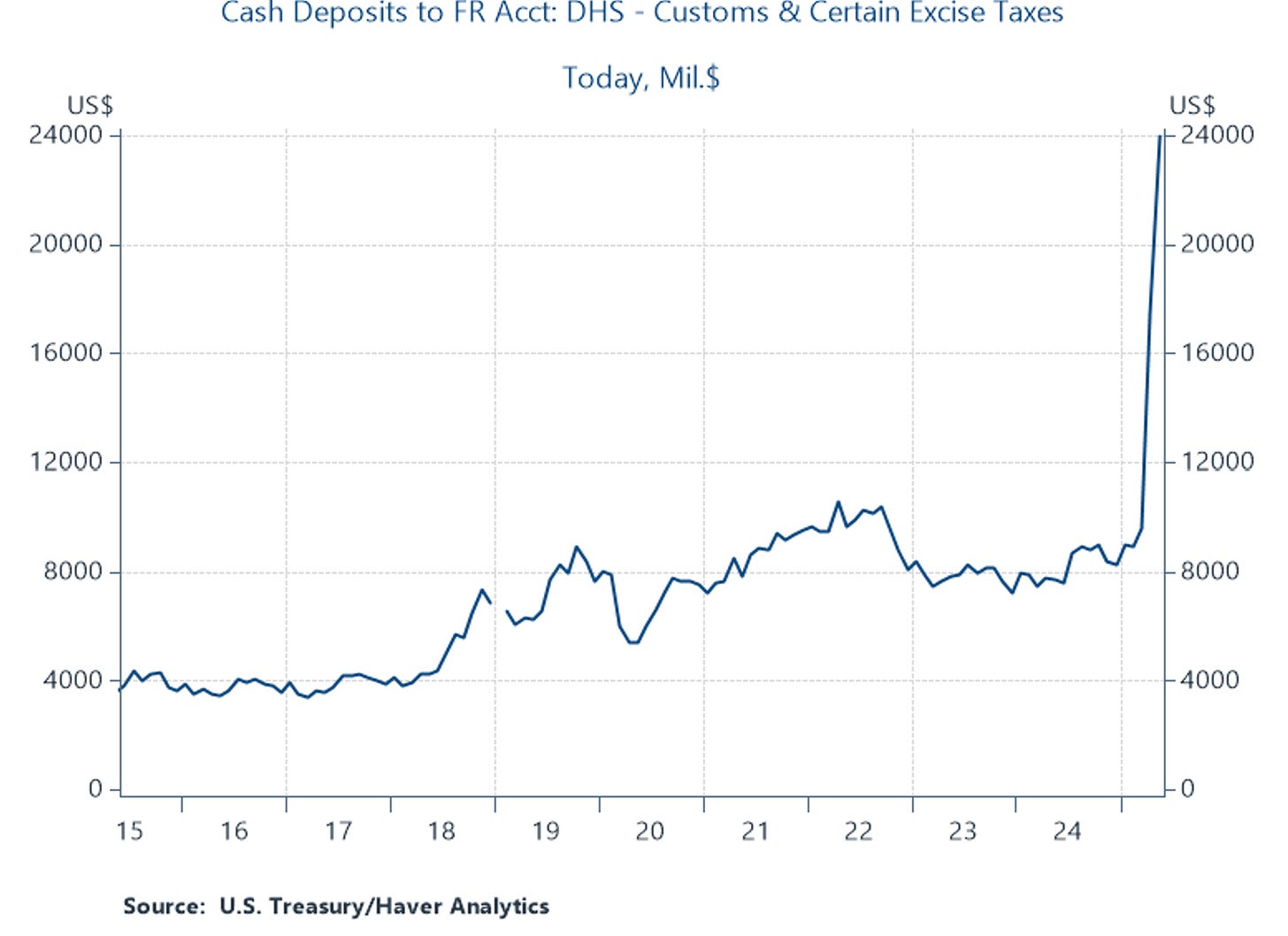

I’ve shown this figure before—monthly revenue flows from the tariffs—which constitute quite a significant tax increase. In fact, they’ve tripled!

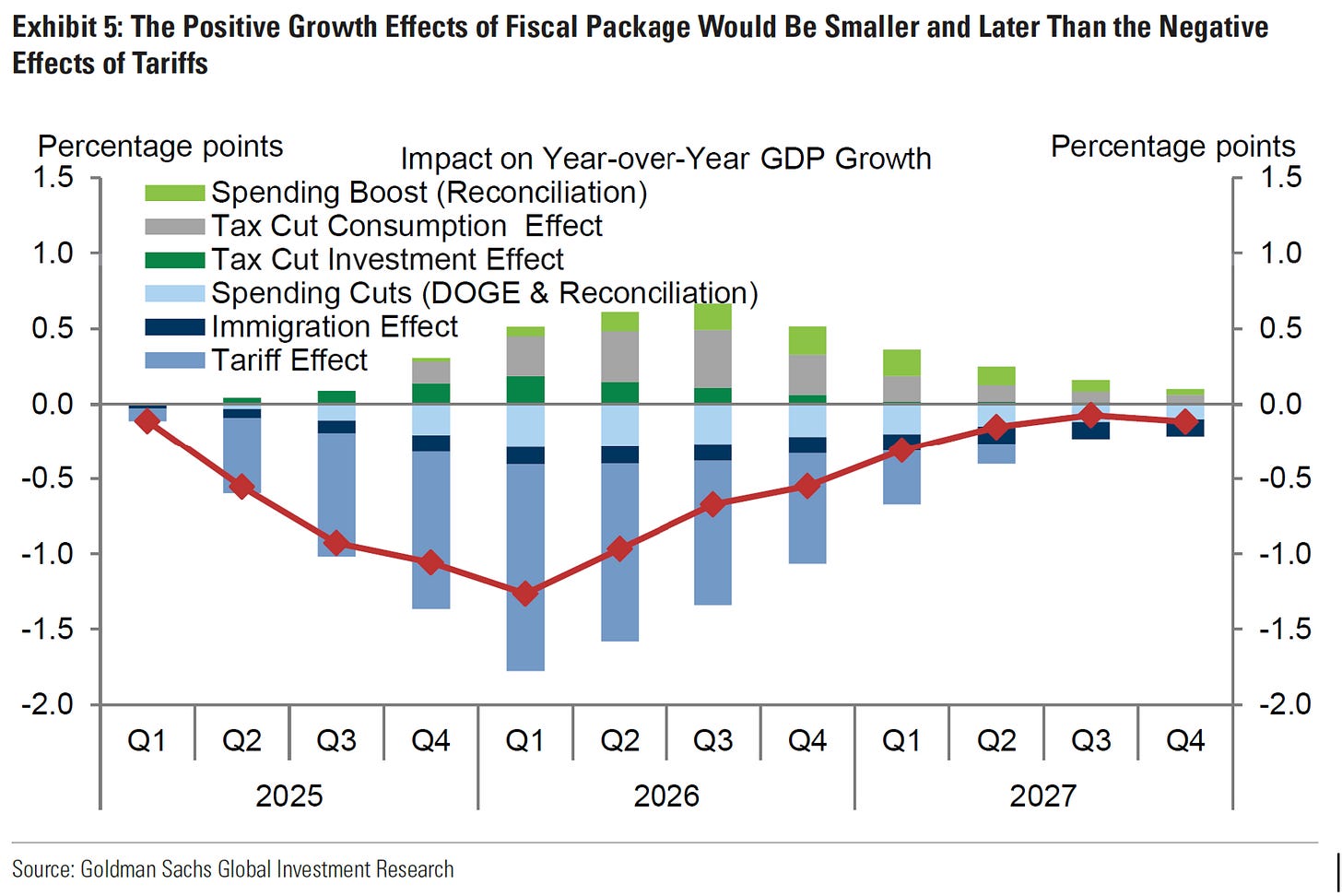

That’s a drag on growth, one which leads Goldman Sachs researchers to conclude that “the hit to growth from tariffs will more than offset the boost to growth from the fiscal package.” Their figure, below, predicts that the sting of the import taxes will subtract about a percentage point of growth this year and maybe three-quarters of a point next year. After that, the growth effects, positive and negative, fade for both the tariffs and the BUBB.

That fade out is also important. The only way that quote about BUBB-derived revenue flows could be true is not only if it raises real GDP growth from its current trend of ~2% to 3% for a few quarters, but for 10 consecutive years, in which case it raises $3 trillion, not $4 trillion (see table 2-4 here). But that’s a very silly squabble because this ain’t happening.

Let’s not waste anymore of our time on this, especially given the fires burning elsewhere. But let’s also not let one crisis distract us from another. These folks love to play the “don’t look there, look here!” game, when we’re perfectly capable of looking both there and here.

I can see the blame game already. We would have got growth if Powell had just lowered interest rates sooner. Feels like Trump is prepping that already.

“If we get 3% growth” is giving off real “if my grandmother had wheels she’d be a bicycle” vibes.