Today’s getting busy so I’ll be quick.

When I was in the gov’t, my watchlist always included the interest rate on our gov’t debt. I constantly bugged the staff to track measures of health/liquidity re our debt auctions, like bid/cover ratios, auction tails, and other obscurities. Then one day it occurred to me to stroll over to the Treasury department and talk to the folks whose job it is to manage our mammoth debt and ask them what they think are the most important metrics.

As you’d expect, they look at everything, but the term that kept coming up in our conversation was the term premium. And trust me, if those guys/gals are tracking the term premium as an important indicator, we should too.

What is this creature? Like AI says, and like its name implies, it’s the “extra return investors expect to receive for holding longer-term bonds (like 10-year Treasuries) compared to rolling over shorter-term bonds (like 1-year Treasuries). It's a compensation for the risk that interest rates might change during the long-term bond's life, and for the uncertainty associated with those changes.”

More broadly, the term premium encompasses, and thereby represents charges for, other risks, including inflation risk (some bonds, called TIPS, automatically adjust for inflation, but most don’t), default risk, and the Trump-admin-and-R-Congress-don’t-know-what-they’re-doing risk. That one looms large these days.

As I’ve been stressing in recent writings, the R budget, now in the Senate where their rules allow for even more deficit financing, is putting some pressure on rates in general and the term premium in particular. But, as always—you know my methods, Watson—historical perspective is warranted.

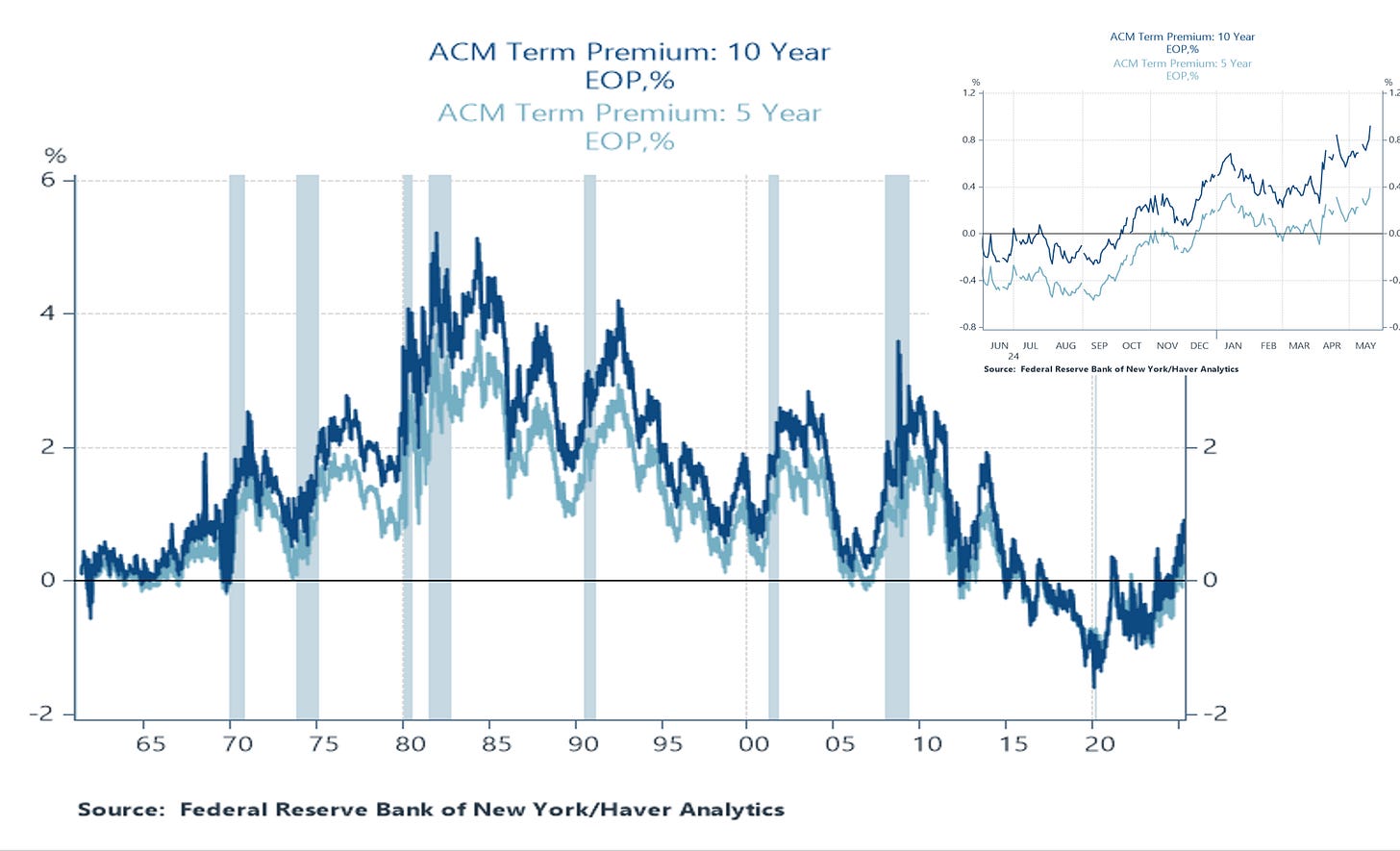

Here is a figure of the term premium on 5- and 10-year Treasury yields, with both the longer-term history and the last year pulled out (the blended interest rate that the gov’t pays on its debt tends to be around the yield on the 5-year Treasury). It peaked in the 1980s amidst high inflation, the Volcker Fed’s sharp rate rate hikes, and double-dip recessions, but was negative most recently, with persistently low Fed rates and inflation below their target.

And now it’s climbing again for all the reasons noted above. Growth is poised to take a hit from the tariffs, fiscal pressures emanating from the world-class recklessness of the budget are in play, and each day brings new fears of incompetency. From just now:

Note that “bond yields…tumble” part. There are many, many factors that drive interest rates, and they’ll always bounce around at high frequencies. But your eyes are not lying: there’s a new, positive trend in the term premium.

I expect this will persist. I don’t see a sudden stop, wherein creditors get so spooked by our current debt burden and its managers that they pull back en masse, leading to a huge spike in rates. I see persistent, gradual, upward pressure. And when you’re servicing public debt that’s around the size of our $30 trillion economy, one point on the rate comes to $300 billion in debt service.

But even more tangibly, Treasury rates are benchmarks for other rates in the economy, most notably, mortgage rates. Here’s the most recent reading of the 30-year fixed-rate mortgage, which is now north of 7%:

Trump said he’d lower prices, including the price of borrowing (the interest rate). As the rising term premia and mortgage rates make unequivocally clear, he’s going the wrong way and he does not appear to know, care, or have any intention of reversing course.

Thank you.

Concise and clear.

There's something happening here.

What it is is pretty damn clear

There's a deranged man with a sharpie over there

Telling the bond market you've got to beware