Of Tariffs and Tax Cuts

Trump and the R's are engaged in a triple-play of regressive tax and spending policies.

If you combine their tariffs (highly regressive sales taxes) with their spending cuts and tax cuts, Trump and the Republicans are raising taxes and taking vital services from low-income people in order to partially offset the cost of cutting taxes for the wealthy.

For all their chaos, global upheaval, tanking of markets, the Trump admin and Congressional majority Rs are doing what such coalitions always do: take from the poor to give to the rich.

What’s different this time is the tariffs. That is, the usual play is to cut spending on low-income programs—Medicaid, nutritional assistance (SNAP)—to help pay for high-end tax cuts. But tariffs, which are sales taxes on imports that disproportionately hit the middle-class and the poor, have not been part of this equation in the past.

As usual, the Center on Budget and Policy Priorities has the evidence. The figure below shows how the Rs proposed cuts to health insurance and food assistance sum up to the same $1.1 trillion that their tax plan cuts for the top 1%. The Medicaid cuts alone threaten health coverage for over 70 million people.

I just can’t see this any other way than taking away things economically vulnerable families need to provide more income to those who want for nothing.

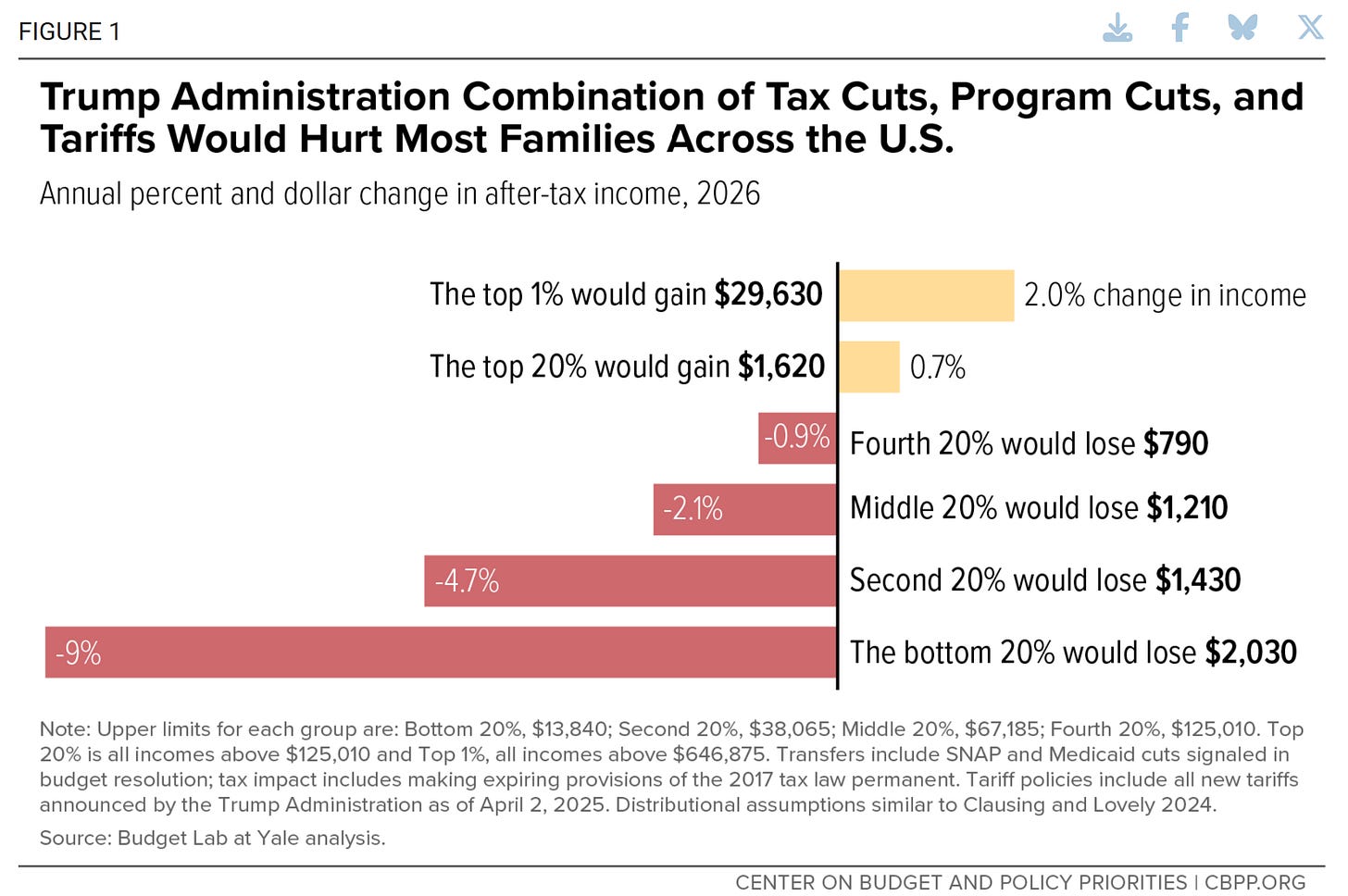

To be clear, I’m not the slightest bit shocked; we’ve all seen this movie before. But the addition of tariffs is especially egregious. In the figure below, Brendan Duke and Gbenga Ajilore from CBPP put it all together, showing the triple-regressive-hit from tax cuts weighted to the top, spending cuts targeting the low-end, and import taxes that disproportionately hit the middle and low-end of the income scale.

I’ll have more to say in coming days about the extent to which the tax cuts make an already unsustainable fiscal path much more so. But for now, I wanted readers to know that just because many of us, myself at the head of the line, have been absorbed in fighting the admin’s breaking the global trading system, we’re not ignoring what these folks are up to with their budget.

We see what they’re doing. We know that it is massively unpopular with the public: polls show that voters overwhelmingly disapprove of more tax cuts to wealthy individuals (76%) and large corporations (70%). Such numbers show that for non-MAGA voters who believed that the Trump administration would come to their economic aid, these actions fit neatly on the fast-growing list of “we didn’t vote for that.” We may not be able to stop them, but we will do all we can to lay bare the economic injustices they’re committing.

[I’ve been asked by media sources what to make of the China trade war. Who will blink first? What should we expect re economic outcomes? My next post will cover those questions, with the caveat that we’re in unchartered waters and no one knows what happens next. But we can still make educated guesses based on relative trade flows, economic conditions, authoritarian degrees of freedom, and more.]

Looking forward to seeing how you game out the trade war with China - and with all the other major trading partners, for that matter.

That this trade war has gone from policy shifts that can be analysed "at the margin" to a very binary issue (125%!!) is, as China noted today, uneconomic.

Yes, prices will rise BUT more and more trade just won't happen. Items will not be available for purchase or sale at any price.

How many fields of grain should be planted or maintained this year? etc. etc.

Talk of subsidies is besides the point. Price changes like these destroy the value of capital.

Madness.