Three Important Data Points: 2 Bad; 1 Good

Housing, the $, and UI claims.

Housing starts tumbled last month, down 11.4%, well below expectations, led by a 14.2% negative spike in single-family starts.

U.S. single-family homebuilding plunged to an eight-month low in March and could decline further as tariffs on imported materials raise costs and offset declining mortgage rates.

As the figure shows, this is a noisy series and though I share Reuters’ concerns regarding where building and borrowing costs are headed, we shouldn’t over-torque on one month’s results. I tried to get fancy and show both the long-term starts with recession bars and a pull-out of the most recent data (readers: does that work?), the latter to show you the saw-tooth signature of noisy data.

But what’s telling here is from the long-term series: new housing is usually cyclical, growing in economic expansions and visa versa. But not in this cycle. This cycle looks more like the 1980s, which featured mortgage rates at 17% and back-to-back recessions.

The fact is, as readers here know, we are in the midst of an affordable housing crisis due to a deep shortfall in affordable supply.

What’s most important now, along with fighting the current administration’s efforts to ignore the crisis at best and deepen it at worst, is to begin crafting the policy agenda to build, baby, build (let the record show I thought this would make a strong tagline for the Harris campaign but no one took me up on it).

In this context, I can only provide the skeleton of the necessary policy agenda, but I’m confident it’s roughly the right one (note that this is the federal agenda; a lot of this policy must be sub-national).

We are stuck in an equilibrium wherein market forces are wholly insufficient to build what we need where we need it. For one, building affordable housing in most places where people want to live does not pencil out for developers, so they instead build higher-end units. Thus, building affordable single- and multi-unit housing, for both ownership and renting, requires subsidies, both for building and financing. An example is the Low Income Housing Tax Credit, the biggest existing tool we have to build affordable rental housing. It has been an effective program, but needs reforms.

Second, the federal gov’t has tried to use carrots to nudge localities to engage in land-use expansion. In Biden-land, we had a program wherein if you wanted your city to win a bid, say for infrastructure investment, you pushed back on some exclusionary zoning. We did a little of that and made a little progress.

But I’m increasingly thinking less carrots, more sticks, i.e., conditioning some of the copious federal support that flows to states and towns on land-use reform. One attraction to doing it this way is that it is understandably very hard for local politicians to push NIMBY residents to accept such changes.

But this is a large, complex agenda requiring deep policy analysis in tandem with political advocacy. It is also extremely urgent and will only get more so under the current administration, who I fear will do nothing useful in this space over the next four years.

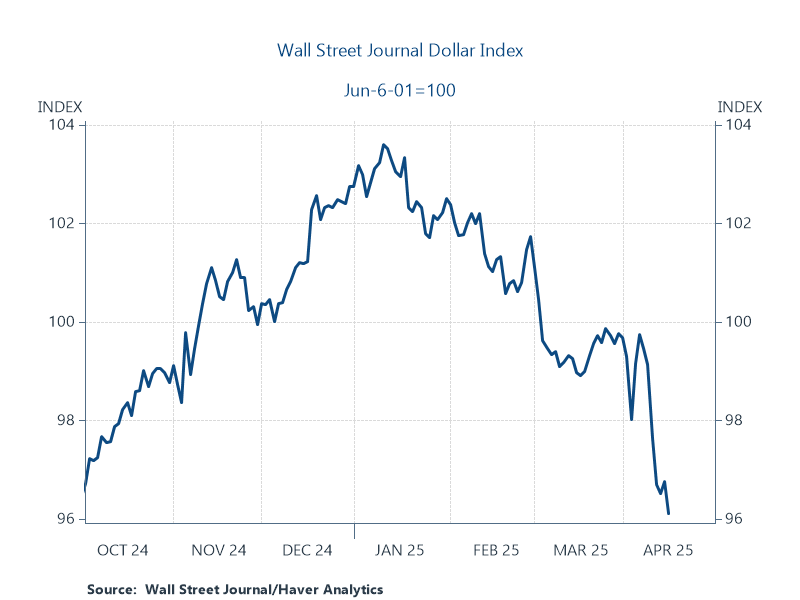

The dollar keeps falling against the value of other currencies. The causes are Trump’s trade war, enmity to our trading partners (excepting those to whom we export “prisoners,” including those illegally detained), policy lurching, and the basic sense among investors that after less than 3 months, Trump has raised the question of whether America is the stable investment they thought it was. The lower dollar can help support U.S. exports, but it makes imports more expensive, and that’s on top of the import taxes known as tariffs.

This new Economist Magazine cover speculates about a potential dollar crisis, a destabilizing financial shock where countries dump their dollar reserves. Is it over the top? Maybe, but that’s pretty much what I look like when I wake up these days.

Finally, once again, Unemployment Insurance claims look pretty stable for the past week, clearly showing that layoffs in the US job market are still not accelerating. Continuing claims—the stock of folks on UI—are up 5% over the past year, which isn’t nothing, and is evidence that hiring has slowed. It’s taking longer to find work, to transition out of unemployment, or from not-in-the-labor force to working.

But, for now, the job market—one of the most important parts of the US economy—isn’t flashing red or even yellow. And yes, the key words there are “for now.”

"build, baby, build" would have been an *outstanding* slogan. It would have driven attention to the problem -- which is a major issue for voters -- and its solution. Perhaps offsetting the cost of eggs.

Being the global reserve currency brings immense advantages: lower borrowing costs, persistent demand for sovereign debt, and unparalleled financial influence. But reserve status is not a birthright. It comes with stringent, often overlooked requirements. In a world where the safety-liquidity-return hierarchy governs global capital flows, breaching the “safety” pillar would be the most dangerous move of all.

https://open.substack.com/pub/marketszoon/p/dollar-privilege?r=58uzcq&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false