Weekend Wrap-Up: False Reality Breakdown, How Bad Was It?, Services Trade

I know I've said it before, but this time I really mean it: what a week!

False Reality Breakdown

Others have made this point, but I don’t want it to get lost in the mix. This isn’t because of my association with Bidenomics, which, no question, had its ups and downs. But the false reality that team Trump inherited a sick, “toxic” economy, a reality they’ve used to motivate this deeply damaging trade war (and DOGE cuts) must be challenged. I thought everyone here made great comments, worthy of your ears. But my spiel at the end outlines this case.

The economy that Trump inherited was, in fact, doing well—very well compared with all other advanced economies. GDP growth was solid (2.4% in ‘24Q4; above 2% on trend), unemployment low, job gains strong, real wages growing. Inflation wasn’t back down to the Fed’s target yet, but, as Chair Powell repeatedly said, that was the “direction of travel.” Forecasts were for more of the same; recession probabilities were not at all elevated, though they have become so in just the past few days.

There is no question in my mind that the best macro-policy for an incoming administration inheriting this virtuous cycle —reliably solid labor demand and disinflation are generating real wage gains that are supporting strong consumer spending that is incenting solid business investment—is to leave it alone. Of course, they’re going to do stuff, but don’t shock a good economy is just such a no-brainer.

I understand that Trump needed a rationale to justify his isolationism and authoritarian impulses to mete out punishments to trading partners. But we should never lose the thread that in so doing, they’ve created a false reality.

But it is one that is breaking down:

President Havisham

We are seeing something unprecedented in Trump’s political career: he’s increasingly isolated within his false reality. There have always been enough people and coalitions who benefit from his fabrications to support his endeavors, no matter their non-reality. It’s just another Trumpian transaction, in this case between the president and the donor class, including the politicians they control: you let me make stuff up, and you get upwardly skewed tax cuts, deregulation, climate denial, etc. They didn’t love the trade war in Trump 1, but it was targeted such that it didn’t derail the markets or the broader economy. And it wasn’t anything like the tax increase we’re looking at today.

The upshot is that when he goes out, as he did yesterday, to say (paraphrasing) everything’s fine, the plan is working perfectly, even his usual allies, outside of MAGA voters, don’t believe him. Businesses, investors, consumers, Fox Business News, the Wall St. Journal, even Ted Cruz (Ari Melber did a great segment on this)! They’re all distancing themselves from Trump, at least for now.

In other words, we may—that’s “may”—be witnessing the limits of his propaganda machine. He’s increasingly inhabiting an alternate reality by himself (along with those who are paid to join him there), not unlike the Dicken’s character Miss Havisham, who Google describes as “a wealthy, eccentric, and embittered woman who lives in a decaying mansion, forever stuck in the past.”

Were he to reverse course today—which he could do with one tweet—this might all quickly revert back to the pre-trade-war status quo. But that’s looking awfully unlikely.

President Donald Trump insisted Friday that “MY POLICIES WILL NEVER CHANGE,” doubling down on his aggressive tariff policies amid plummeting U.S. stock markets.

How Bad Were the Past Two Days?

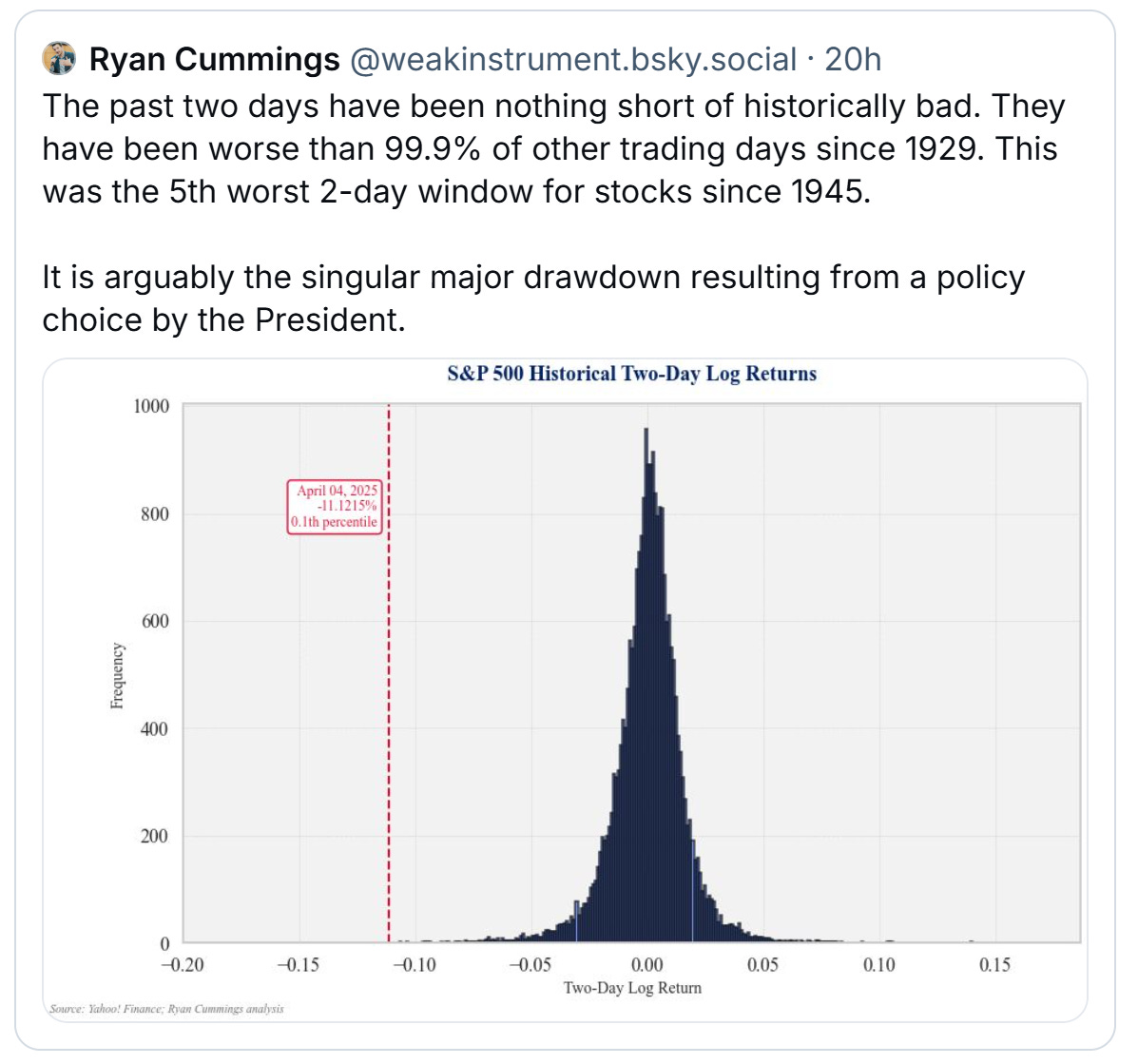

Ryan Cummings of the Stanford Institute for Economic and Policy Research (where I’m a jolly good visiting fellow) posted this after the market closed yesterday:

As Liberation Day was followed by two Liquidation Days, the S&Ps market cap was down over $5 trillion.

There are those who argue “who cares what happens in the stock market? It’s not the economy.” That’s certainly why you shouldn’t pay any heed to its daily bips and bops, which, as Ryan’s figure shows, cluster around zero. But there are good reasons to pay attention to a move of this magnitude:

—This move, unless it is quickly reversed, will significantly tighten financial/investment conditions, which are highly correlated with near-term growth and business investment.

—Even if it is quickly reversed, it will send the VIX (a stock volatility index, nicknamed the “fear” index) even higher. Consider this a measure, shown below, of business/investor uncertainty right now.

—I can’t think of a precedent for such a massive own-goal kick by an American president. They'll always take credit for good economic outcomes on their watch and deflect the bad ones, and we can all scurry about trying to assess the validity of such claims. But this one is unequivocally, unambiguously linked to Trump’s trade war.

Liz Truss’s fateful budget proposal comes close, but she was a piker compared to the trillions in wealth evaporation in this case. And she was gone in a few weeks.

—While it’s true and highly relevant that stock market ownership is concentrated at the top of the wealth scale, I also always keep this table in mind. A lot (61%) of older, middle-class, working households have retirement accounts invested in the market.

Services Trade

You don’t hear about from team Trump, but for many years, the U.S. has run a trade surplus in services, which include financial services, entertainment, tourism, intellectual property, including tech services, and more. In Miss Havisham’s table Trump’s world, we’re ripping off and pillaging these trading partners, who should therefore launch their own trade war against us.

I’m not being facetious. It has been reported that the European Union is considering retaliatory tariffs against U.S. service exporters, which, as they discussed on the NYT’s Daily podcast yesterday, include a lot of Trump’s tech bros.

As you see, the services surplus is around a quarter of the goods deficit. But it is a very important trade channel and it’s not hard to see why trading partners on the other side of that surplus might decide to fight back.

This week, Republicans gave up their Free Market ideology by mostly supporting Trump's tariffs. Also this week, after decades of saying that tax cuts pay for themselves and that our national debt is the root of all economic evil, Republicans proposed to change the budget baseline to current law but ignore the sunset provision for Trump's tax cuts to try and make extending Trump's tax cuts forever budget neutral. That's some massive reality denial. If they can't get that past the parliamentarian or vote to overrule the parliamentarian's decision, I expect they will go full Ryan and just instruct the CBO to say that their budget balances in the long run.

Republicans also went full anti-family values in the House by going home instead of facing a vote on a discharge petition that would allow House Members to vote remotely if they recently had a baby.

So Republicans gave up on Free Trade, Free Markets, caring about deficits, claiming that tax cuts pay for themselves, and family values,(for a week or so for family values), this week. Yup, it has been quite a week!

I looked up on ChatGPT that indicated US trade services surplus of 314 $B with profit margins of 20 to 40% and a US trade goods deficit of 1060 $B with profit margin of 5-10%.

Using 5% profit margin for goods and 40% profit margins for services, other countries are getting $53 billion in profits with their goods exports to us and we are getting $125 billion in profits with our services exports .

Trump's delusions are truly dangerous.

We are firing PHD scientists who are literally saving the world and at the same time wishing for Americans to replace $3/hour auto assemblers.