Weekly Wrap-Up: Budget BS (with a side of Bitcoin BS)

I don’t know at what age you stop believing things aren’t there if you close your eyes, but I'm sure it's less than 64, which is the average age in the Senate.

IMHO, the most important economic development of this past week is the potential passage of the Trump/Republican Budget. I covered some important data from the week here (note possibility of slower consumer spending) and note that this week’s jobs day is on Thursday due to the Friday holiday (I’ll have a post up shortly after its 8:30am ET release). But this budget is a true emergency. I don’t know if it can be stopped, but whatever you can do to help stop it, now’s the time.

From WaPo this AM:

In other words, this ain’t over. Resistance, as I frequently say, is *NOT* futile. It’s tough, especially with Trump now engaged, threatening the no votes with fire and brimstone. And let’s be clear: some Senate Rs are “noes” for now because the bill doesn’t make enough cuts to offset the highly regressive tax cuts (my bold):

The holdouts secured a commitment from Senate Republican leadership to back a proposal from Scott to reduce the rate at which the federal government reimburses states that have expanded Medicaid under the Affordable Care Act for new enrollees, according to Johnson. “We just have their commitment that they’re going to do everything in their power to make sure this passes,” Johnson told reporters.

The most egregiously unjust budget in the history of our nation

The Senate version is looking worse than the House version, both in terms of cuts to health coverage and food support, and in terms of its addition to the national debt (more on that next). Here are two figures posted by Bobby (Kogan), who is doing invaluable work fighting this horribly unjust monstrosity.

“Senate Republicans are calling to cut Medicaid and CHIP by over $1 trillion, growing to an 18% cut by 2034.”

“The Senate Republican bill would cut SNAP by $186 billion - 22% by the final year. This would be by far the largest SNAP cut in history and would rip food assistance away from millions of households, including families with kids and veterans.”

I know that those of us in the opposition—whose numbers, for the record, are prodigious—are understandably prone to superlatives these days. But this is budget is truly unprecedented in its punishment of the economically vulnerable in order to partially offset the cost of bestowing tax cuts on the wealthy.

Deficit impacts: If we pretend it’s not there, it goes away, right??

Though the Senate version of the bill is even more deficit financed than the House version—CRFB: “The Senate bill would borrow almost $1 trillion more than the House bill”—they’re pretending it costs about one-tenth its true cost, arguing that the other nine-tenths is just extending policies that are currently in place. This is called using current-policy baseline instead of current law baseline, and there’s no reason to go into it, other than to point out the extent of their falsehoods and denial. No one is convinced by this nonsense gimmickry.

Source: Washington Post

I will note the following: if the vast majority of the bill is just extending policy that’s already in play, then you can falsely claim a lower price tag (I know: $440 billion ain’t “low”) but you can’t also claim brand-new, miraculous growth effects, as the admin does here.

But what do all these trillions mean to regular people in their everyday economic lives? It’s glaringly obvious why the health coverage and SNAP cuts will hurt, but this deficit biz is awfully abstract.

I’ve got a big, new paper on this with some colleagues from the Stanford Institute for Economic Policy Research coming out soon; I’ll post a draft here when I can figure out how to do so. But here’s the summary:

For years, deficit hawks warned that our gov’t debt was on an unsustainable path, but they were wrong, largely because the interest rate on the debt was so low relative to the economy’s growth rate, meaning we were growing fast enough to service our debt without hurting the economy through upward pressure on rates or crowding out private borrowing, leading to lower investment.

But as the key figure below shows, this is no longer the case. The interest rate now equals the growth rate and, if that sticks, that’s a whole different world. It means our debt service will be a much heavier lift, takes key metrics (as we show) outside of their historical range, and raises the probability of debt shock which jams up interest rates, which hurts everybody.

We must be somewhat agnostic as to whether the blue line (r, or the interest rate) will revert back to its earlier trend, but our analysis elevates risks than point in that direction, including anti-growth trade policy, and more so, the deficit impact of this very budget we’re talking about.

How did it come to this?

As I sit here watching this awful, and—this is important—deeply unpopular budget bill make its way through the Republican Congress, I suspect I’m not the only one thinking about what got us to this point. I’ll have more to say about that in later posts, but there’s a way in which this is a culmination of a many-decade-long Republican project to destroy faith in gov’t, an effort to which Democrats have insufficiently responded.

For years, R’s came to Washington with an explicit message that “gov’t doesn’t work!” and an implicit one that said “send me up there and I’ll make sure to keep it that way.” And who benefits when majorities believe—correctly!—that DC is a cesspool of vicious partisanship, endless gridlock, phony math, blatant fact abuse (R Senate leader John Thune: “This budget will lower the deficit”)?

If the answer to that rhetorical question is not immediately obvious to you, please reread this post.

A Use Case for Crypto?

Readers may recall that Ryan Cummings (also of SIEPR) and I posted a highly critical take on crypto currencies, arguing that we saw no use cases outside of scams, and that the blockchain is a clunky blockhead. We specifically and loudly worried that the extent to which the crypto bros have a) lobbied up, and b) brought the Trump family in on the scam meant that we could see this volatile accident-going-out-to-happen find its way into more traditional finance.

Well, now we have this:

I understand that there are people out there who like to bet on these assets, and I wish them luck. I’ve never argued they should be banned (I’ve argued for guardrails to protect the innocent).

But how can anyone read this and not have your head explode?:

“Turn your home into a Bitcoin acquisition engine,’’ one of the start-up firms called Horizon, said in a post on X."

I’ve been around long enough, and am an avid student of the Minsky Cycle, to sniff out a financial implosion in the making. And this stinks bigtime.

There are two plays here. One, use your Bitcoin as collateral for a cash loan to buy a house, and two, that nonsense above re trading home equity for Bitcoin (plus a lien on your home...hey, what could go wrong with that?).

But consider this from the NYT piece, which Ryan and I were banging on about:

This week, President Trump’s housing director, William Pulte, said he would direct Fannie Mae and Freddie Mac — the nation’s big mortgage finance firms — to consider home buyers’ crypto investments as part of their overall wealth in assessing whether they can afford a mortgage. Traditionally, a home buyer’s cash savings and stock investments are what mortgage lenders consider.

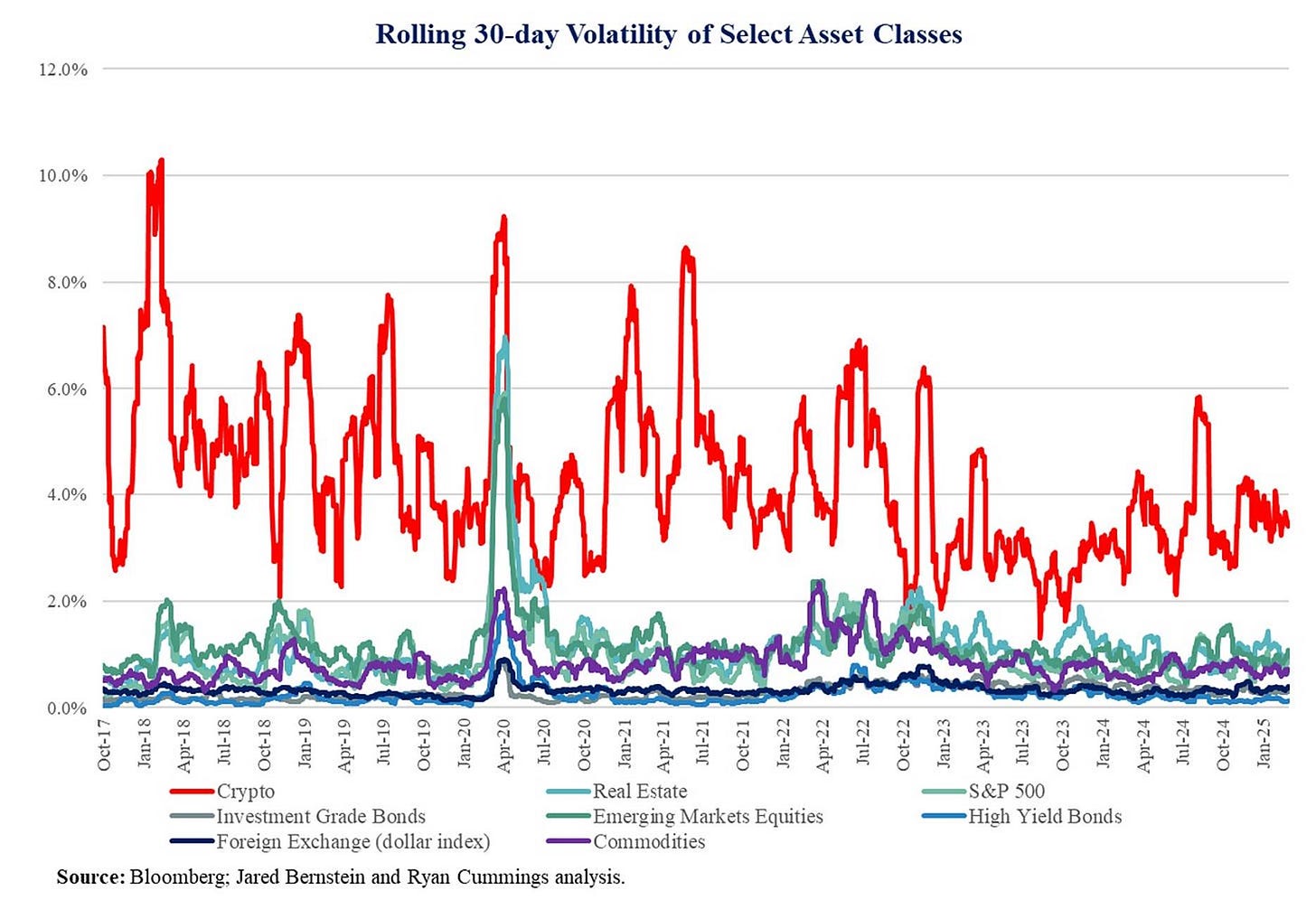

Remember, crypto lacks a decisive characteristic of a legit currency, particularly germane in this context: “For money to be useful, it has to be a reliable store of value, but crypto’s volatility, as shown in the figure below, disqualifies it from utility in commerce.”

This is just the latest example, of which the budget is the much larger one, of how the Trump administration is betraying its promises to attack the affordability crisis. I interact with many experts in affordability housing policy, and trust me when I tell you: none of them had “use crypto!” on their list.

It didn't take for Crypto to get into the real financial markets. 2008 showed what the housing industry can do to the economy. The ink on the "Genius Bill" isn't dry and the Crypto fox is already in the hen house. Donny and the Oligarchs will Hoover up everyone's money when the economy crashes in a year or two.

Question: Most descriptions of OBBB emphasize that it would make life worse for the “needy” (horrible term). Would it not also expand the numbers of those who cannot afford a decent life? For example, the likely implosion of nursing home care threatens both those in care and their potential home caregivers, who would have to forgo paid work to provide the care. Is there a way to calculate this effect?