What if resistance *isn't* futile??

There's an inherent contradiction unfolding in real time.

There is an inherent contradiction is the current flurry of policy actions by the new administration. It is not particularly nuanced or hard to see, and it has the potential to gather momentum in coming weeks and months.

It is the increasingly obvious gap between the actions of the Trump/Musk administration and the living standards of most Americans, many of whom brought them to power. It is far too early to bring dispositive evidence to bear on this claim, but hear me out as I take you through a few things I’ve seen in recent days, all of which underscore this contradiction.

The first thing to look at here, which sets the stage for all that follows, is this NY Times tracker of all the administration’s “major moves.” Hit the “economy” filter and take five minutes to go through what comes up. There is simply nothing—zilch, nada, zero—there to improve the living standards of mid/low-income families, and a lot of entries that go the other way. (To be clear, I’m counting “directed federal agencies deliver ‘emergency price relief’” as the obvious nothing-burger it is.)

Tariffs dominate the list, and while the non-China ones and the “de-minimis” have been suspended (“Trump pauses de minimis repeal as packages pile up at US customs”), it is widely recognized—another key point that I’ll get back to in a sec—that tariffs raise consumer prices.

Speaking of consumers, I can unequivocally assert that shutting down the Consumer Financial Protection Bureau will also hurt economically vulnerable households and help financial services’ firms like the one led by the banker who named his yacht Overdraft. (The CFPB passed a rule to significantly lower such fees.)

Some of what’s on the list is inside baseball but with potentially highly negative impacts for the middle class. For example, as Daniel Hornung and I will show in a forthcoming piece, privatizing Fannie Mae and Freddie Mac in the way former Trumpies have advocated for will make an already stressed housing market even further out-of-reach for most homebuyers, along with putting upward pressure on the 30-year mortgage rate, which currently stands at 7%.

I also guarantee you that “Supported the growth of the cryptocurrency industry” will end badly for regular folks. What’s unfolding here is a scam that would make Ponzi himself blush. (Note: I’m reading this book on the origins of this industry. It’s as interesting as it is entertaining.)

Please go through this list, and if you think I’m getting this balance wrong, let me know. But I’m confident I’m right about this one.

Next, here’s a headline from a Wall St. Journal article from the end of last week.

The piece opens as follows:

The Trump bump in consumer confidence is already over.

Tariff threats, stock market swings and rapidly reversing executive orders are causing Americans across the political spectrum to feel considerably more pessimistic about the economy than they did before President Trump took office.

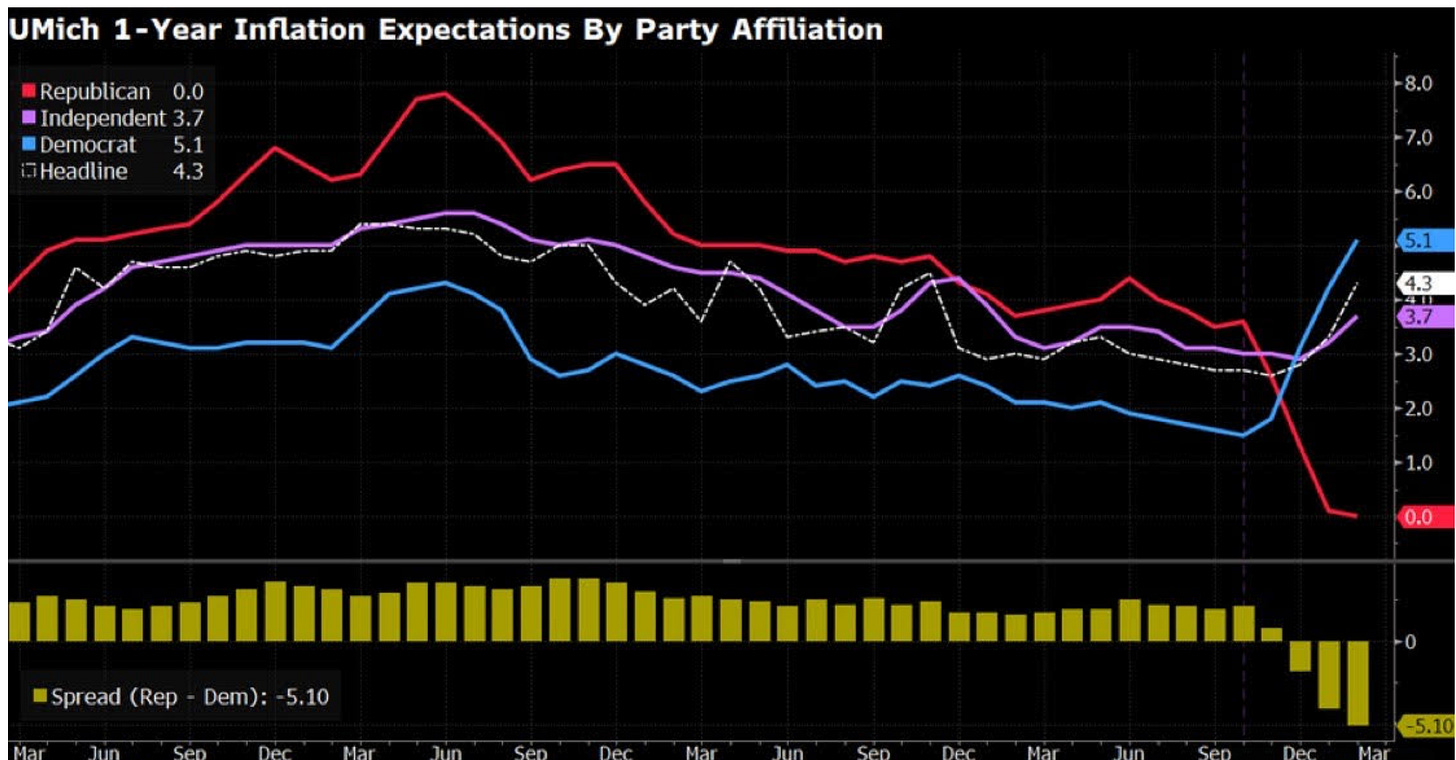

Consumer sentiment fell about 5% in the University of Michigan’s preliminary February survey of consumers to its lowest reading since July 2024. Expectations of inflation in the year ahead jumped from 3.3% in January to 4.3%, the second month in a row of large increases and highest reading since November 2023.

Now, this requires caveats. The UMich finding is from a preliminary survey of relatively few people that is both jumpy and, as shown below, reflective of partisan views (vs. non-politicized takes on economic conditions).

Source: Bloomberg

But the article cites other sources to support its headline, including recent deterioration in the Morning Consult consumer confidence poll, one to which I give considerable weight (though it’s behind a steep paywall).

The next piece of supporting evidence on the policy thrust/living standards contradiction regards tariffs. Polling and anecdote (again, see WSJ piece) make a strong case that average folks know that the costs of tariffs are passed forward to consumers. The media, which often falls prey to both-sides-ism in such cases, has been solid on this, and that too supports my theme here.

I want to underscore important caveats to this argument.

First, there are surely MAGA Trump supporters for whom “sticking it to the libs” and “dunking on the Ds” Trumps any living-standard concerns. I can’t speak for such folks, but it may well be that they’ll happily pay more overdraft fees knowing the Don & Elon kicked some lefty butt.

Second, as noted, it’s too early to lean too far into these points. Non-MAGA Trump voters (NMTVs) are likely to give the administration time to deliver on pledges to lower grocery prices, housing costs, and interest rates.

But the gap between their agenda and these goals is strikingly wide, and again, much of their policy agenda pushes the wrong way. This means that at some point, a sentiment among NMTVs begins to sound something like this:

“Enough already with the retribution to the enemies list, the DEI, the adding new states to the union, taking over the board of the Kennedy Center!! You guys need to start dealing with the pressures on our daily lives, which have nothing to do with everything else you’re going on about.”

Call it a thermostatic reaction, an inherent contradiction, comeuppance for bait-and-switch, or just the predictable outcome from a group that’s masterful at campaigning but bad at governing.

But I’m seeing early signs of trouble for them, and that could be good for the rest of us.

It isn’t. RESIST, DISOBEY.

Contact the White House. March in the streets. Why?

Mr. Harrison Fields, a spokesperson for the White House said this yesterday:

“Any legal challenge against Trump’s executive orders are attempts to undermine the will of the American people.”

Mr. Fields is under the illusion that we support his boss’s lawlessness. Let him know otherwise. Contact Mr. Harrison Fields: https://johnadamsingram.substack.com/p/contact-white-house

Introducing Mr. Fields and his lawless boss:

It’s not, and I’m resisting.