Repairing the Damage

We need to start thinking and planning--loudly!--about how we're going to reverse the damage that Trump and Rs are meting out on America.

One of the more interesting, and more hopeful, questions I like to think about is: how long will it take to repair the damage done by the Trump administration? As a member of the Biden admin, I have personal experience fixing some of what got broken in Trump 1. (EG, they did a good job supporting the creation of the COVID vax but blew the distribution; also, international relations).

The trade war is an obvious candidate, but we now need to think about their newly passed budget bill in this context.

The more one learns about the bill, the more it resembles a computer virus embedded in our economy and society, infecting policy in dozens of areas, and such viruses are hard to extract. The big ticket items—the upwardly skewed tax cuts and downwardly skewed spending cuts—have gotten ample attention. The cuts to renewable energy production, a bit less so; same with reductions in debt relief for college loans. And then there are a slew of “earmarks”—tax breaks for special interests—that have gotten very little attention. Politico does an excellent job collecting e.g.’s, some of which I relegate to an appendix.

Extracting such a virus will require the same type of focus and drive that Trump and the Rs brought to the task. In a recent post, I argued that Ds need to both emulate this focused energy while reverse engineering the tariffs and budget on behalf of actually helping people who need it, versus pretending to do so while screwing them.

What will that look like?

Unwinding the sweeping (versus narrowly targeted) tariffs, given that they’re non-legislative, should be a slam-dunk, though it will require Ds not to fold when some interest group, be they industry or union, objects.

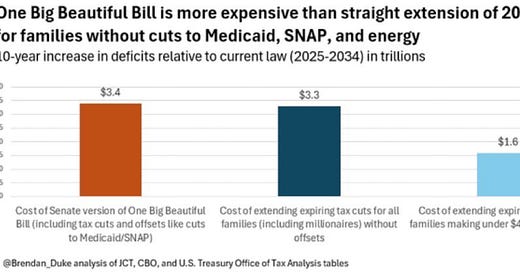

We’re also going to have to be willing to both unwind some tax cuts and seek new revenues. We already did some of the analytic work re the latter task in the Biden administration: our proposed budgets—which never got anywhere in the divided gov’t we mostly faced—proposed significant, highly progressive revenue-raising tax hikes, but only on a narrow slice at the top of the income scale. That’s not enough to get back on a more sustainable fiscal path, which is where we need to be if we’re going to not only reverse the new cuts in the safety net but also address affordability shortfalls in housing, child care, health care, and higher ed. But it’s the right place to start, as shown in this chart from Brendan Duke (see third bar).

That shouldn’t be a heavy lift for Ds, at least not for those who aren’t in the same donors’ pockets as the Rs who passed this beast. In fact, our proposed tax hikes above $400K had a lot of support from Ds, many of whom pushed us to go further.

They were right, and this means that Ds are going need some spine to reverse tax cuts in the bill that have some constituent support but are terribly designed. The no-tax-on-tips leaves out a big group of tipped workers with no federal tax liability from which to deduct the tax break (they’d get actual, and much needed, help from an increase in the federal minimum wage, still stuck at $7.25!). And while the tip deduction may help some of the waitress, it does nothing for the cooks. The $6,000 seniors’ deduction, along with the lifting of the SALT cap, mostly give more money to people who are doing fine without the extra help.

Next, we’ll need to restore the cuts to the safety net. Again, this should not be a heavy lift for Ds, especially given the vast unpopularity of these cuts. The questions at that point will be more about expansion. Health coverage and groceries are at the heart of the affordability crisis, points that should lead attacks on the bill (the cuts mostly kick in after the midterms, so this argument must be made in bomb-defusing terms I discuss below). Thus, expanding coverage further up the income scale is worthy of consideration, as is lowering the age for Medicare eligibility. Again, this takes revenue, which circles back to reversing tax cuts and adding new revenue increases.

Then we’ll need to get back to the industrial policy that was generating important, significant investment in renewable energy production. This too shouldn’t be a heavy lift as the production tax credits that the bill ends had very broad support, which is one reason for the deep unpopularity of the Trump budget. Even traditional Rs like the Chamber of Commerce and energy companies that recognize renewable energy production is part of their and our futures don’t understand the motivation for these cuts which seem to be driven wholly by Trump’s nostalgia for coal and distaste for wind turbines blocking his view.

Reversing the harsh deportation measures, along with funding for the wall and ICE, must also be part of this effort, but this one is complex and deserves its own later post. Any D action in this area must be forthright about the need to maintain secure borders. But fair-minded people should all take solace from the fact that the Trump admin’s cruelty in this place is recognized by majorities of Americans, who are both unhappy and shocked by the ongoing extremism of masked, unidentified people grabbing people off the streets and throwing them into vans and airplanes, not to mention the local realities of losing a significant chunk of their workforces.

The only way we’ll be able to do any of this is through the same budget reconciliation process that the Rs used to pass this bill (it avoids a Senate filibuster). Which is another way of saying that the ability to right the wrongs being perpetrated is conditional on Trumps’ opponents gaining power. This, in turn, requires us to deal with the timing of the bill wherein many—not all—of the goodies (tax cuts) come first and the pain (health coverage and SNAP cuts) come later. But campaigning on defusing a time bomb seems like a perfectly reasonable strategy to me, especially if we keep the pressure on by constantly pointing out the falsehoods used to sell the package.

For example, the admin claims deficit reduction from the bill starting this year, followed by quite large reductions next year. That’s unlikely, and requires tracking. Ending credits for the production of renewable energy occurs this year and next, and this too should be scrutinized for job losses and energy-cost impacts.

I hate to say it but this is only day 167 of this admin. There will be a lot more damage to reveal and elevate along with damage-reversal planning to do as the months roll on. But, especially on July 4th weekend, I like to think about this as a labor of love for this country, which needs a whole lot of that right about now.

Appendix: Earmarked tax breaks in the new bill that you might have missed.

From Politico:

Senate Republicans not only kept a House-approved provision exempting gun silencers from a long-standing $200 tax on firearms — they dumped the tax on all guns it applied to, except machine guns and what the legislation terms “a destructive device.” That cost: $1.7 billion.

There’s a new supersized deduction for business meals — though only for employees at certain Alaskan fishing boats and processing plants, with the measure stipulating the facilities must be “located in the United States north of 50 degrees north latitude” though not in a “metropolitan statistical area.”

There’s a $2 billion break important to the rum industry and, tangentially, Louisiana, said Sen. Bill Cassidy (R-La.), a tax writer…“We have the highest per capita intake of alcohol in the nation,” he said.

…an expansion of a little-known break that Silicon Valley investors have used to nix tax bills on tens and even hundreds of millions of dollars in earnings from Internet startups. Another spends $26 billion to create a new $1,700 credit for people who give to groups providing scholarships for children to attend private school.

Sen. Mitch McConnell (R-Ky.) secured a $7 billion tax cut for farmers that allows them to postpone paying some of the capital gains taxes they owe when selling off farmland.

…a $1 billion provision allowing “spaceports” — which the legislation defines as “any facility located at or in close proximity to a launch site or reentry site” — to sell tax-exempt bonds…Sen. Ron Wyden, the chamber’s top Democratic tax writer, said in an X post that “Trump’s wedding gift to [Jeff] Bezos and birthday gift to [Elon] Musk were tucked in the new budget bill.