Data_Note: Income, prices, and the spike in tariff revenues

Inflation is drifting back down to the Fed's target. But there's a good chance that the trade war will disrupt that favorable trend.

This morning’s income and price report for April showed that the PCE inflation measure—the preferred gauge by the Fed—rose just 0.1% for the month, as expected, for both the headline and core indexes (headline: 0.10% core: 0.12%). Real disposable (after taxes and transfers; i.e., income households could use to buy stuff or save) rose a solid 0.7%, through real spending was up a weak 0.1%. Mechanically, this means the savings rate bumped up a bit.

BLUF: The report shows inflation coming down nicely to the Fed’s target, but like many recent reports, tariff price effects are probably not much in here yet (maybe for durable goods; see below), meaning this probably won’t nudge the Fed one way or the other off of their wait-and-see mode. One shouldn’t over-torque on one month’s weak spending, but I’m watching this closely—as you know, I didn’t love yesterday’s spending markdown to 1.2% for Q1. It’s too soon to tell whether lower spending and higher savings represents precautionary behavior by households, anxious about the chaotic trade war’s impact on their economic lives. But I’m not ruling it out.

You can see how the Fed should like what’s in here, given how the yr/yr plot of the headline and core price indexes are drifting down back to target:

If there were no massively chaotic ongoing trade war, one that’s on-again-off-again in the course of a single day, the central bank would surely view this as a signal to ease/normalize their interest rate stance. But that’s a lot harder to do when you’re worried about the impact of the tariffs.

In fact, here’s the path Goldman Sachs researchers expect for headline PCE inflation. It goes up again before it goes down.

Source: Goldman Sachs Researchers

A few other key stats from the report:

—Real disposable income has been solid of late, up by a nice 0.7% in both March and April. Both gov’t transfers, which were up in April, and paychecks are behind the gains.

—But real spending was weak in April, up just 0.1%. That’s nothing necessarily to worry about; in March, real spending was 0.7%. But it caught my eye because we learned yesterday that real spending for Q1 was marked down to 1.2%, a tepid pace for a key variable.

—Higher income, lower spending means a higher saving rate, which came in a 4.9% in April, the highest rate in about a year.

—As noted, tariff price effects are still not obviously breaking through in these reports, though durable goods inflation was up 0.5% in April, its highest month since Sept ‘22.

—Another favorable disinflationary indicator is core services (ex housing services) inflation. It’s not back to pre-pandemic rates yet, but the trend is our friend.

In sum, a solid report with a few warning signs. Inflation looks good but one must remain nervous due to the trade war; income seems fine but consumer spending is now officially on my watchlist. If the Trumpies had just embraced a love-it-and-leave-it-alone stance toward the good economy they inherited, we’d be in a better place.

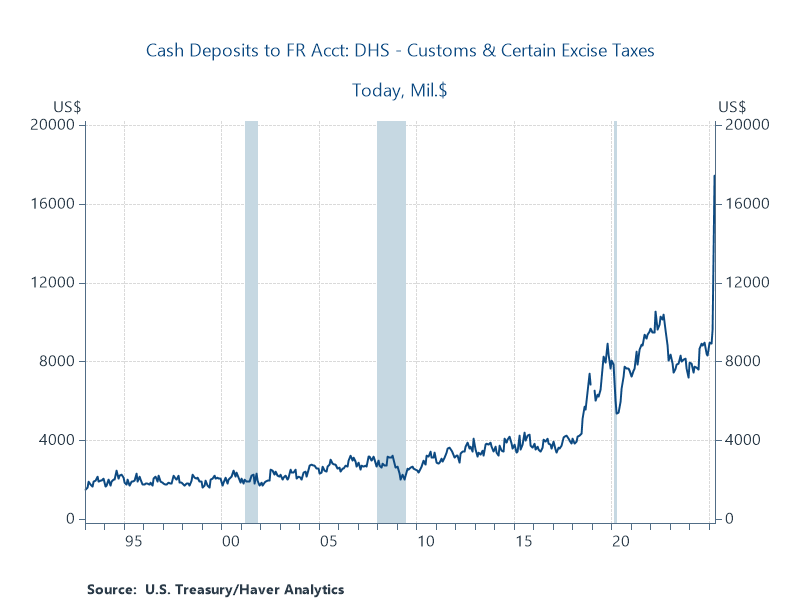

Tariffs revs spike

The figure below shows monthly revenue flows generated by (mostly) tariffs. The $17.4 billion in April is a clear historical record, and the take so far this year is $45 billion. I show this for three reasons.

[I updated/corrected this next paragraph which misstated how this might be working.]

One, it’s hard to believe exporters are lowering their prices that much (“eating the tariffs”) with this big a spike. They may be splitting some of the difference, but this large an increase in customs duties suggests exporters’ probably haven’t adjusted their prices down much to protect consumers from higher prices.

Second, it shows how these duties are a significant revenue source for an administration scrounging for revs to offset the cost of their highly skewed tax cut. But think also of the incidence (who pays the tax). We know these import taxes are passed forward to consumers and we know that those consumers live in disproportionately middle- and low-income households. In other words, not only is the cost of the tax cuts for the wealthy partially offset by cutting health coverage and food support for the most economically vulnerable families. They’re further partially offset by highly regressive import taxes.

Third, here’s an interesting take you might not have thought of from Neale Mahoney and Ryan Cummings re who gets the rebates if the reciprocal tariffs get struck down (as they were earlier this week, until that decision was temporarily stayed). The original ruling says firms must be rebated for the import taxes they paid as reflected in the figure above. But because some share of those costs were surely passed forward to consumers as higher prices, any such rebate to the firms is essentially a windfall profit—a transfer from consumers to the importing firms.

Nice work, Trumpies.

Although the government is supposed to refund the wrongfully collected tariffs back to the importers, does the incredibly sloppy Trump Administration have the records and willingness to do so? I would not hold my breath expecting my windfall if I were an importer. More likely a write off as a bad debt.

EATING needs to be applied to putting stuff in our MOUTHES. Too few people are on Ozempic and Mounjaro now but soon the PILL form will be available and the numbers of people NO LONGER BINGING will increase. Walmart CEO has already pointed to 25% fewer food purchases for those who take the GLP-1 drugs. Hurrah!! Get rid of fatness is our goal. Tariffs on food from Mexico and Canada will help solve this problem by increasing PRICES so binging is too expensive and the PILL will decrease the need to eat nonstop 24/7. Huge economic shifts will happen and the Economists seem to be unaware since they are NOT interested in actual bodies. Not interested in the fact that the AVERAGE height -- 5/4" --American female has a waistline of 38.7 INCHES where the WHO says that 35 inches is OBESE. Yes 65% of us are obese right now.. Not 40% which uses the fraudulent BMI. YES we will EAT the higher food costs so sales will not drop too much but our consumption will. Same is happening right now in the booze biz. Look at the bodies. READ 80bites.com/anti-book