Data_Note: The U.S. Job Market Just Keeps Plowing Ahead, As Usual...

There are a few soft spots under the hood in the June job market, but the toplines came in better than expected, with solid payroll gains, lower unemployment, and higher pay.

Payrolls rose by 147,000 and the unemployment rate ticked down to 4.1% in a better-than-expected report on the June jobs market (expectations were for 111,000 on jobs and 4.3% for unemployment). Revisions to earlier months were also positive, raising employment by 16,000 jobs in April and May. The average monthly gain over the past three months—a good way to smooth out some noise—is 150,000, a healthy pace of jobs gains that’s consistent with low unemployment and rising real wages.

[The June jobs report was released today because tomorrow is a federal holiday. Happy 4th!]

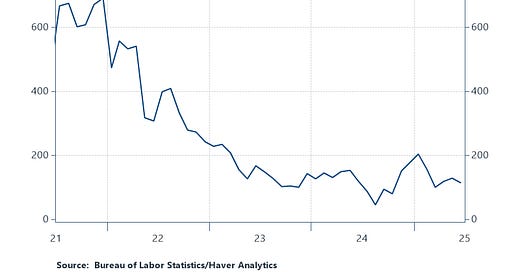

Of course, we must open the hood, and here the report is a bit softer than it first appears. Private employment was up just 74,000 last month, its lowest month since October of last year. Even here, though, the three-month average of 115,000 is, if not strong private-sector gains, still pretty solid (see figure). Weekly hours of private-sector workers ticked down a tenth.

So, what boosted the topline number? Mostly state and local government employment, which was up an unusually large 80,000, their largest monthly gain since January of 2023. Federal gov’t jobs fell again, down 7,000 and down 69,000 since January.

Are state and local gov’t’s hiring laid off federal workers? Unlikely, and certainly nothing we can discern from today’s report. Local jobs in public schools popped up 23,000 in June, which seems inconsistent with the theory that former federal workers are crossing over in state/local gov’t jobs.

The diffusion index of 49.6% meant that half of private-sector industries added jobs and half cut them. The index has been sliding down lately, reflected weaker hiring, though the rate of hiring picked up last month, from 25% in May to 28% in June (caveats: this is noisy monthly indicator from the Household Survey, while the diffusion index is from the payroll survey).

Manufacturing employment continues to slump. It was down 7,000 in June, identical to May’s decline, down 90,000 over the past year, and down 150,000 since its peak in February of 2023. To some degree, this is a downward adjustment following stronger-than-average hiring in factories coming out of the downturn, as consumers stuck at home due to the pandemic significantly ratcheted up goods’ purchases. But it also could reflect more structural factors, like worker-replacing investments (politely referred to as “labor-saving technology”) by manufactures.

Hourly wages were up by a solid 3.7% for private-sector workers, and 3.9% for the subset of of the workforce that’s either blue collar or non-managers (~80% of total private employment). Though we do not have inflation for June yet, those rates will surely surpass it, meaning ongoing real wage gains, on average, and higher real gains for lower-paid workers.

The tick down in unemployment partially reflected a decline in the labor force, as the participation rate fell by a tenth. For prime-age workers, however, the LFPR ticked up slightly, to 83.5%. This indicator has toggled between 83 and 84 percent for over two years now, which is a bit higher than pre-pandemic, a sign that the persistently strong labor market has pulled in prime-age workers.

Okay, so what’s the bottom line? What should we take from all these numbers and from the fact that the report bucked expectations for a weaker June job market? Here are some thoughts:

—First, let’s dispense with any questioning of the data. I, of course, cannot say for sure but the likelihood that the Trump admin is cooking the data is about zero. The people who build these reports at BLS have deep integrity and I’m confident they’d know and we’d know if any such funny business was afoot.

—Economists are especially lousy at predicting this report. One should not be surprised by upside or downside misses.

—Bond yields jumped when the report came out. This is because markets thought the report might come in below expectations, which they thought could pull forward the next Federal Reserve rate cut.

—Where’s the negative impact of all that chaotic and ill-founded Trumpian economic policy I inveighed against yesterday?! Like I said, there is some softness to this report, though that solid real wage story remains important for keeping the expansion on track. Still, it takes a while for tariffs to show up in prices, growth, jobs, and I think it’s coming.

We’ve heard from businesses that are exposed to the tariffs that they’re putting expansion plans on hold due to the uncertainty about where the trade war is headed. And we should be clear that resolving uncertainty isn’t the end of the story if the tariffs that are ultimately set end up at rates that are a lot higher than they’ve been.

For example, the many American companies that export here from Vietnam, including Nike, Lululemon, Under Amour, Apple, who, in many cases relocated factories to Vietnam from China to avoid crossfire in that trade war, were negatively surprised by the 20% tariff allegedly agreed upon in that framework, announced earlier this week.

This new Atlanta Fed CEO Survey is also instructive in this regard: “In the most recent survey, which closed on June 6, 40 percent of respondents cited tariffs or trade policy as their firm's most pressing concern. Prior to mid-2024, these concerns were essentially nonexistent.”

This next slide from the same survey is particularly revealing re: CEOs views on jobs and tariffs (see the figure on the right). There’s a lot going on in this chart but the main point is simple: firms exposed to tariffs expect considerably less hiring than firms who source inputs domestically.

As I keep saying, actions have consequences, and you can certainly see the impact of the trade war when you consider that the import taxes (i.e., tariffs) collected by border agents (taxes paid by American importers, to be clear, not by exporters) hit their highest level on record in June, coming in at $28 billion for the month.

But all that said, so far, even with the few wrinkles I noted, the job market is mostly sluffing all of this off, generating jobs at a good clip and boosting real wages. That’s enough to maintain forward momentum, at least for now.

In 295 days the USA went from immigrants are eating cats and dogs to joking about feeding immigrants to alligators.

A small nit on your comments.

Public school employment is always hard to measure in June and September as contracts activate (September) and terminate (June). The last day of school, often sometime in the middle of June, falls unfortunately very near the establishment survey measurement week. This year local public school employment, for example, seemed to have decreased by 300k not seasonally adjusted, but reported a modest 23k increase on a seasonally adjusted basis. Really, it's hard to know if local public education is trending up or down.