Weekly Wrap-up: Trade War (+Bonds), Stuff to Read/Listen to, Data_Notes

I know I keep saying this, but...what a week!

I don’t want to get imprisoned for quoting Lenin but: “There are decades where nothing happens; and there are weeks where decades happen.” A few observations on the trade war, budget negotiations (which we must not let get lost in the fog of trade war), and the soft/hard data gap.

Trade War

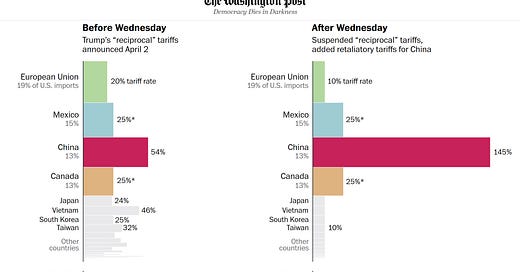

Let’s review where we are here: This WaPo graphic provides a useful look at how Trump’s tariffs (d)evolved last week after the 90-day pause on the reciprocal tariffs. The graphic is already stale, however, as he also just exempted the quarter of Chinese imports that apply to tech goods, including computers, smart phones, and more (see my write up from yesterday; these imports still face a 20% tariffs and the other 75% still face the bat-crazy 145% tariff).

What the graphic doesn’t convey is the shock to the global system that’s underway thanks to one person’s thoroughly misguided mission to punish any foreign business that ever sold us anything. The average effective tariff rates of 27% in the two bar graphs are 10x the rate that previously prevailed. Also, I don’t take that 27% on the right seriously because it’s non-dynamic. That is, businesses hit with the 145% tariff will have to stop trading with China, a fact already documented by many news accounts. As a maker of educational toys put it, “We’re being asphyxiated by our very own government.”

So, who will blink first in this US/China standoff? According to this morning’s reports, Trump and Xi are enacting the same dance I did in junior high with Elaine Bennett (“I want to call her, but maybe I should wait to see if she calls me…”). I kid you not:

The Trump administration has been waiting for the Chinese leader, Xi Jinping, to call Mr. Trump personally, but Beijing appears wary of putting Mr. Xi in an unpredictable and potentially embarrassing situation with the U.S. president.

Xi loves me, Xi loves me not.

Below, in the section on media to bring to your attention, I take you through my analysis of the blink question, though, as noted, Trump already blinked yesterday, presumably due to some of his rich tech-bro-funders getting to him.

In other words, he’s caved twice so far, which is a good sign as far as it goes, but it doesn’t go anywhere near far enough. Lasting damage has been done and the magnitude of the still-in-place tariff regime is easily enough to generate more financial upheaval and even a domestic, if not global, recession.

Speaking of financial upheaval, in the copious media work I’ve been doing, there’s been a lot of interest in what happened with bonds last week and why that development, vs. the ups and downs—with more downs than ups—in the stock market, seemed to spook the president.

This FT headline gets you most of the way there:

The bond market is a deep and complex market—US federal gov’t debt held by lenders is about the size of our GDP: $29 trillion—where up can be down. That is, interest rates on bonds go up when their price goes down; ergo, the recent selloff led to yield spikes. And there’s some complicated debt trades being unwound in what’s called a “dash-for-cash” that’s part of all this. But I appreciated the WSJ keeping it simple: “U.S. government debt is doing badly because, well, investors don’t want to buy it.”

Of course, that’s hyperbole, but it captures the key insight. U.S. debt is both foundational to global finance, which is one reason Trump blinked. The reason is that global investors consider it to be basically risk-free. Yes, there are idiots who regularly threaten that status in debt-ceiling debates, but markets have learned that this is largely (extremely boring) theater.

But Trump is threatening this national reputational treasure. Back to the WSJ:

An aversion to buying Treasurys at the moment is actually pretty easy to understand. The Trump administration’s erratic tariff policies have created so much uncertainty that investors have been reluctant to make any directional guesses about where the U.S. economy would be in 10 years…When it became clear Treasurys wouldn’t fulfill their traditional safe-haven role, many investors saw even less of a point in holding 10- and 30-year paper. They started demanding a higher reward to do so relative to short-term maturities.

That higher reward, aka “risk premium,” spiked last week. And remember, when your carrying $30 trillion in debt, another point on the interest rate is $300 billion more in debt service. All because of…well, I’ll get to that next.

Things to Read and Listen to

—Life is too short to spend much time deliberating on Trump’s psychology (this diagnosis gets you all the way there), but I recently argued that long before you start to sanewash any of this nonsense, recognize that “it’s all about getting other leaders to call him up and grovel.”

Jamelle Bouie does a much better job with that here.

—Sticking with the NYT, I found this “debate”—it really wasn’t much of a debate—to be worth a look. While Cass is popping up as one of the few who will argue on behalf of the tariffs, he doesn’t much do so here. But what was interesting to me about this is what wasn’t here. Cass, Rose, Summers, all lean in various degrees into an important point that’s getting lost in this debate. U.S.-style globalization, what Dani Rodrik calls hyper-globalization, really has hurt significant swaths of people/communities and it has demonstrably and very deeply damaged our politics.

The way I think about this is: the fact that Trump’s trade war is massively destructive doesn’t obviate the fact that there are real political and policy issues regarding globalization’s impact that require action. More to come on that but here’s where I’m coming from.

—The best place to visit if you want to understand the damage Congressional Rs are teeing up in their forthcoming budget, featuring tax cuts for the rich and spending cuts for the poor, is cbpp.org. I summarized some of their work here, but we all have to make a lot more good noise on this.

I was having dinner with a friend this week, who said, “Everybody needs to stand up!” Which really resonated.

—I enjoyed coming on the Inside Economics podcast with Mark Zandi and the very sharp Moody’s squad. Check out the who-will-blink-first discussion re China/US. I thought maybe US had a bit more leverage based on relative trade flows—we buy a lot more from them than they do from us (>3x)—and our economy has been stronger (though the Trumpies are dulling that edge). Their authoritarian regime (though there too, we’re seriously backsliding) can perhaps absorb more pain then ours, but they can’t endlessly ignore the trade war’s damage to their mercantilist (export-growth-driven) model.

Mark made a good point re the CCPs ability to offset pain with stimulus—there’s no dysfunctional Congress, so that’s an edge point for them.

But then Trump blinked anyway, on the electronic imports, so the puts-and-takes are already a bit stale.

Data_Notes

—The big data reports of the week were UMich consumer sentiment, which is just in the freakin’ toilet—overall sentiment way down, inflation expectations way up—and the CPI, which came in cooler than expected.

—The survey data is so-called soft data, and we’ve talked a lot about the large, persistent gap between hard (inflation, jobs, GDP) and soft data. But as we discussed on the Moody’s podcast, the cooler-than-expected inflation news from the week (CPI and PPI) likely also reflected weaker demand. Mark mentioned energy, which is clearly reflecting demand shortfalls, and Matt pointed out a couple of (small) categories in the CPI that may—I think probably do—reflect weaker demand, e.g., hotels and airfares (the latter has an energy component, an example of how lower energy inflation can sneak into the core index).

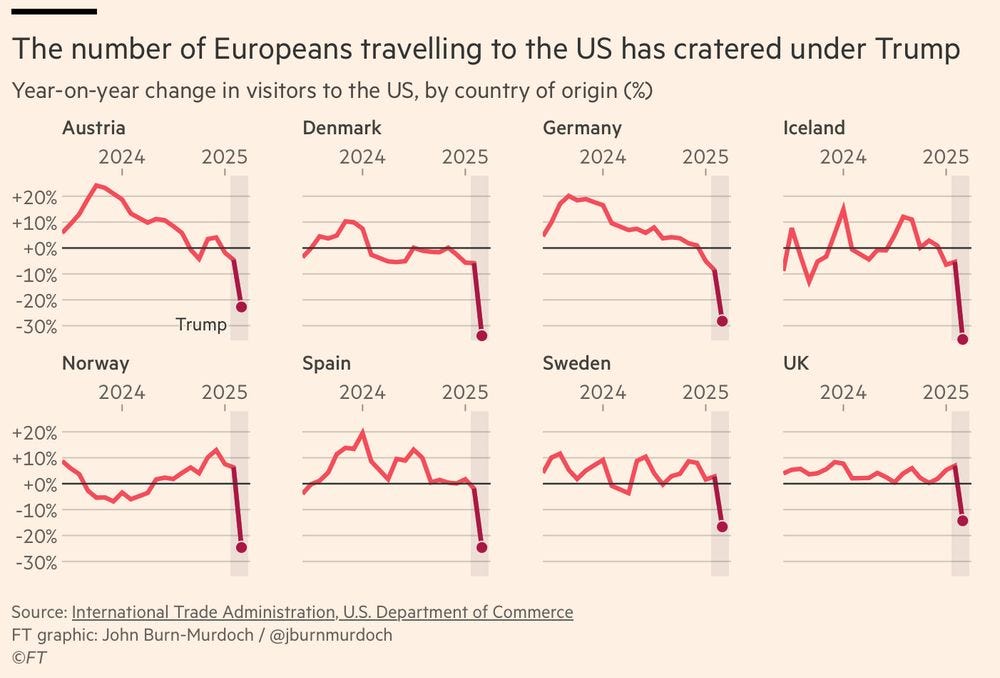

On that last point, I found this figure posted by Jonas Nahm on Bluesky to be quite suggestive:

If such trends persist, they will become important, hard data points.

So, we have less tourists coming here and more lending flowing there. Like I said, what a week.

"That higher reward, aka “risk premium,” spiked last week. And remember, when your carrying $30 trillion in debt, another point on the interest rate is $300 billion more in debt service."

I understand that, because of its uncalled for self destructive nature, it is being called the "moron premium."

I get that you and PK are first and foremost economists and the tariffs are so insane that you're bound to focus a lot of your column inches there.

But DOGE chainsawing vast swaths of public services needs much more comment than it's been getting. The negative externalities are likely as damaging to US welfare and productivity as the tariff madness, although unlikely to provoke a financial crisis. From ceasing to inspect for food and drug safety - to ceasing to do cybersecurity or protect against fraud - to defunding science & medical research - to sabotaging social security and IRS systems - to ripping away headstart and housing vouchers - to stopping environmental pollution - to badmouthing vaccines & likely messing with approvals for new drugs and vaccines - to messing with air traffic control - to corrupt outsourcing to insider cronies - and on and on. Some of these may result in spectacular disasters. Wiith others the harm will be less visible or take longer to be felt. All will take a toll on US quality of life. Many in cold economic terms will make for a less productive workforce and economy.