Date_Note: Weekly Update: Housing, UI, Consumer Sentiment, Markets, Polls

Ticking through the week’s data with brief commentary; do check out the polling bit at the end.

Housing

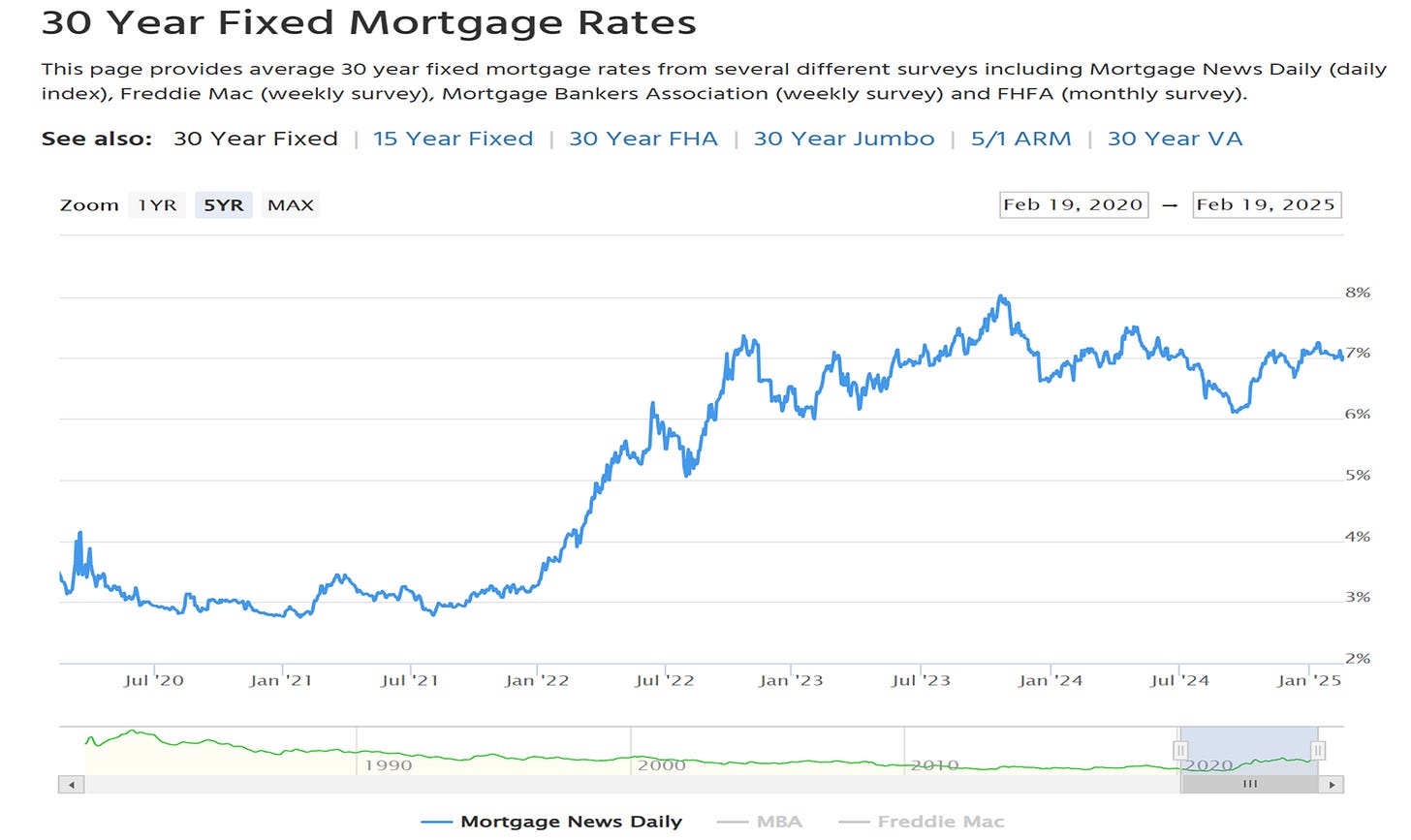

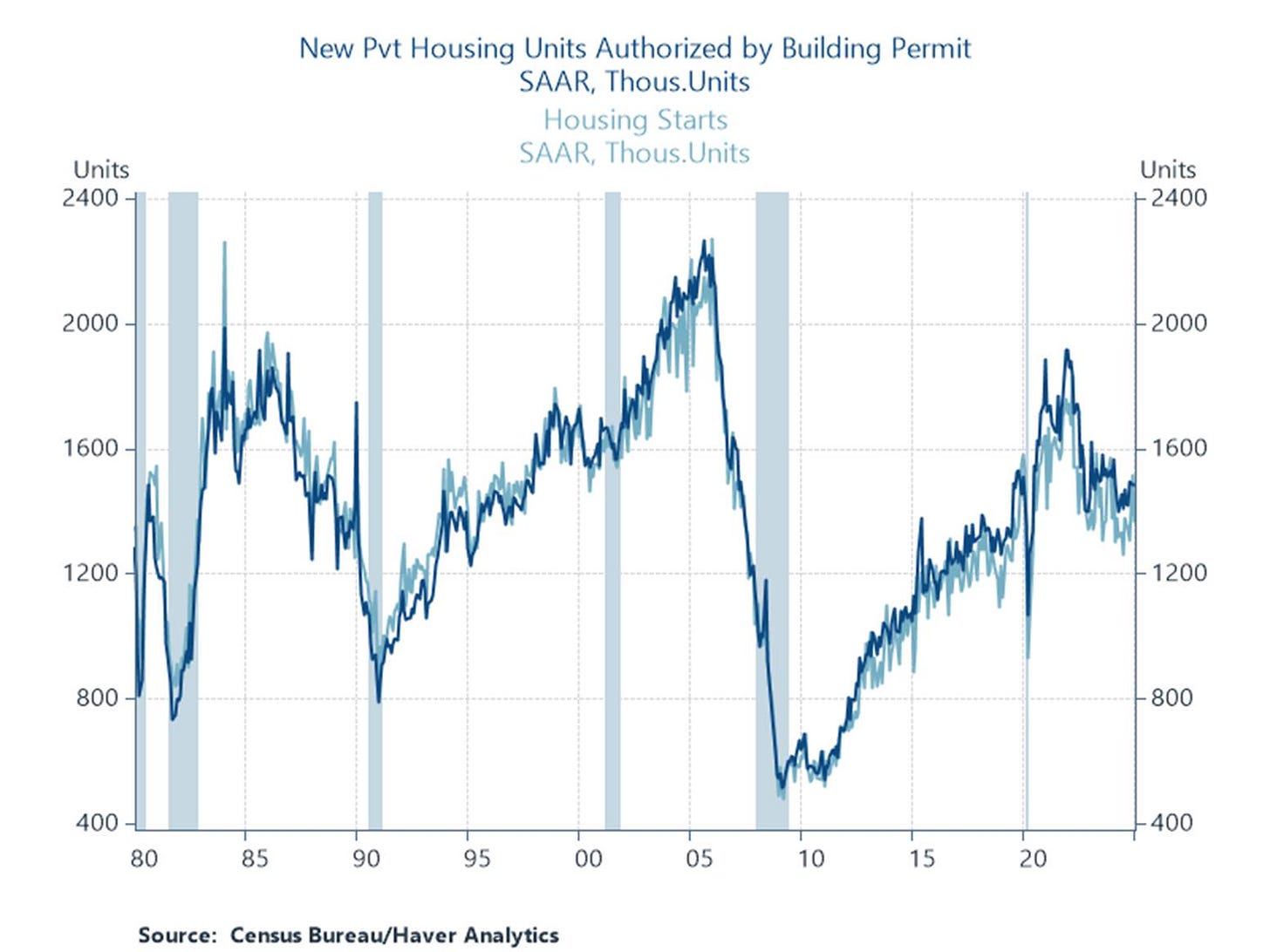

New homebuilding, aka housing starts, was down almost 10% in January, but that was mostly unusually cold weather as well as a bounce-back from December’s strong 16% gain. Still, the housing market is terribly undersupplied, especially regarding housing that’s affordable for middle- and lower-income home-seekers. Not to mention the fact that high mortgage rates—stuck around 7% (see figure)—are “locking in” people who’d like to move. That means too little churn and lack of access of supply for families starting out (I recently got triggered by a supposedly cutesy article in a real estate journal: “How to make your starter home your forever home!”).

A longer-term view is instructive. Homebuilding, shown below through permitting and starts, was strongly pro-cyclical in the 90s and 2000s (much too strong in the latter as the housing bubble inflated), but counter-cyclical in the 80s and the current expansion. Real estate crashed in the 1980’s following high inflation, the Volcker rate hikes (mortgage rates peaked at 18%), and once again, strong (boomer-driven) demand colliding with inadequate supply. We face similar dynamics in this cycle, but with 35 more years of zoning restrictions.

Labor Market

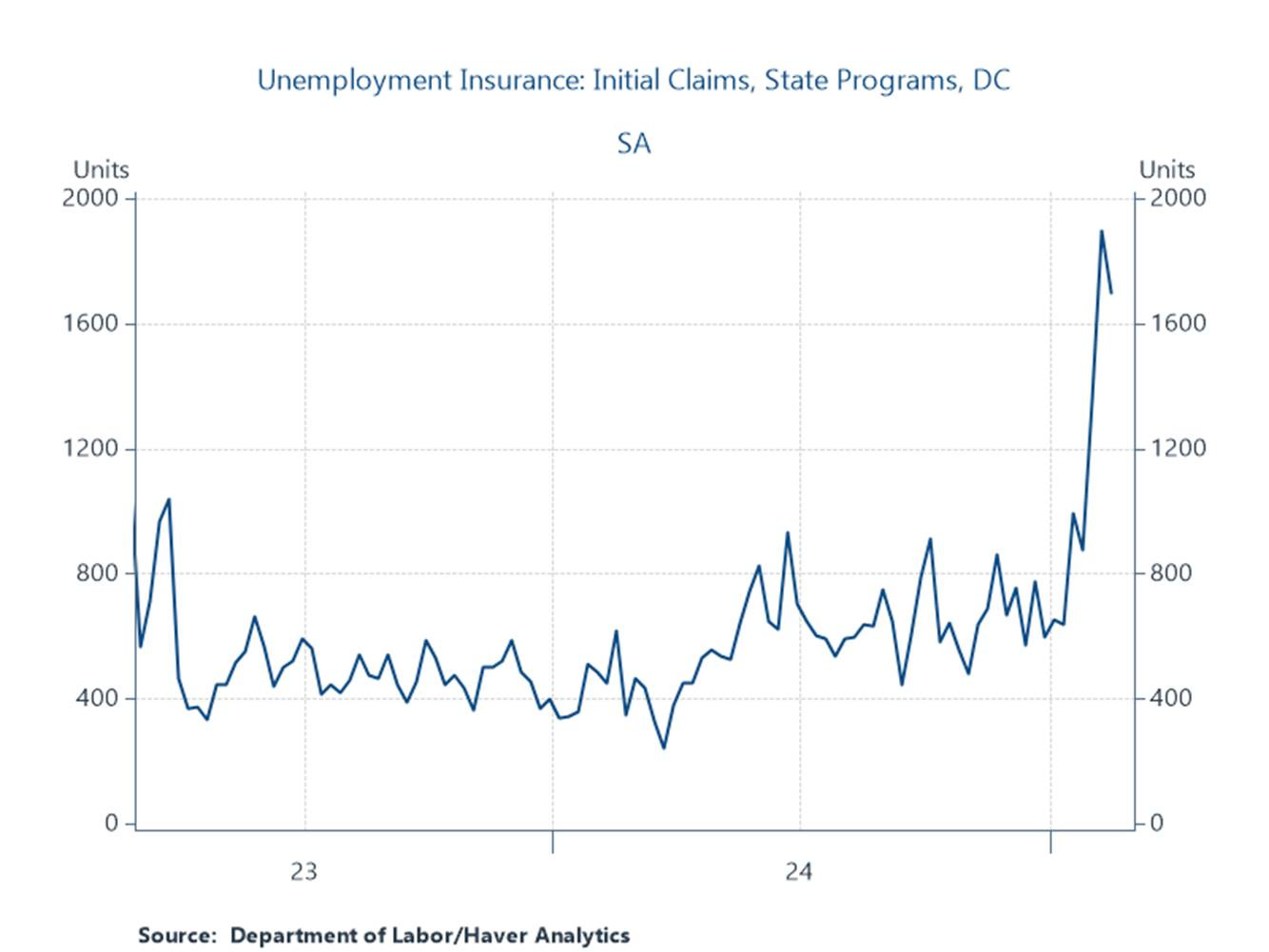

Unemployment Insurance initial and continuing claims were up 1,000 and 24,000, respectively, in Thursday’s report, but the less noisy 4-week moving averages were down for both. These weekly reports continue to be notable for the lack of evidence of accelerating layoffs. In plain speak, the U.S. labor market remains solid, despite the daily upheaval of our politics.

Speaking of that, it’s too early to see a large spike in claims from the Musk admin’s layoffs, in part because federal gov’t workers are scattered across the land. But this DC initial claims spike, which for now is a relatively small 800 claims, is very possibly indicative of what’s to come.

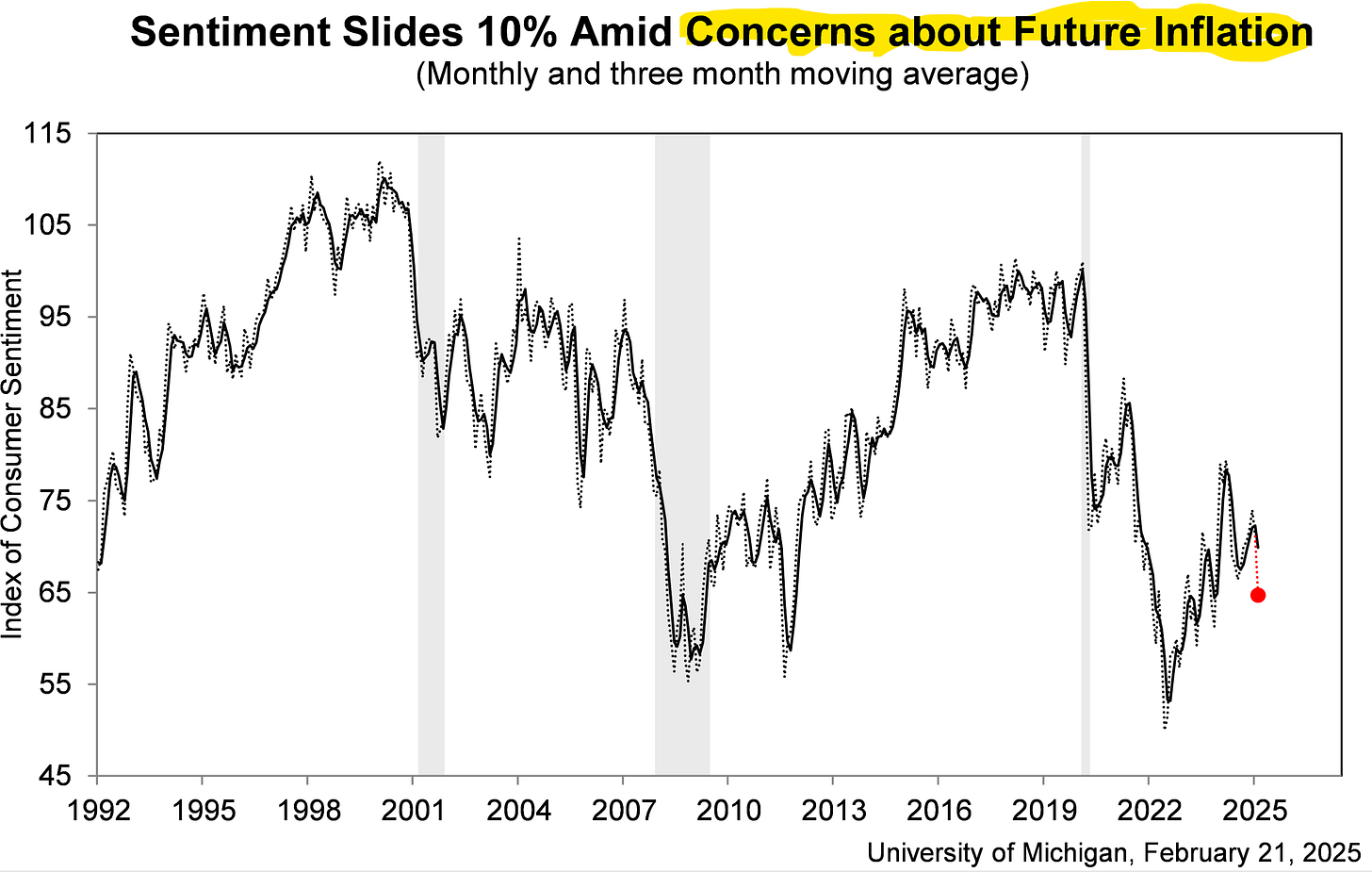

University of Michigan Sentiment Index: Umich consumer sentiment came in even more negatively than expected for February, with overall sentiment down 10% on concerns about tariff-induced inflationary pressures (see figure; also, see Polling section below). Both near and (more-worrisome1) longer-term inflationary expectations kicked up, with longer-term expectations moving from 3.2% to 3.5%, the largest monthly pop in that variable since May 2021. There was also a hefty “19% plunge in buying conditions for durables, in large part due to fears that tariff-induced price increases are imminent.”

One thing to keep in mind about this survey right now: it’s increasingly reflecting politically partisan sentiments that muddy a pure consumer sentiment signal. But the fact that majorities are worrying about the impact of the new admin’s policies is fully consistent with the new polling data I review below.

Markets: The Ten Year…

One of the most important variables in the current economy is the interest rate on 10-year government bonds. It reflects concerns about inflation (risk: upside), the sustainability of the fiscal path (upside), growth expectations (solid), the Fed’s intentions (upside), and it’s also an indicator of the growth of the government’s debt service burden (upside). It’s been pretty stable at around 4.5% in recent weeks (4.49% as of this writing), and the bond market has largely priced in the upside risks just noted. But volatility has been elevated in this market, and investors are appropriately nervous about elevated uncertainty and upside risks to the rate.

New Polling Data

I’ve written a number of posts about the inherent contradiction between the Trump admin’s zone-flooding, renaming bodies of water, commandeering the Kennedy Center, retribution, etc. versus delivering on campaign promises of lower prices and interest rates. My prediction has been that other than MAGA voters, his supporters’ patience for his and Musk’s escapades will, sooner than later, run thin.

It's too early to tell, of course, and part of this is a common post-election-post-honeymoon bounce. But the economic numbers in particular are consistent with my theme, and when a number of different polls move in the same direction, they’re probably telling us something about shifting sentiment.

See here for a full review, but a few highlights:

Trump’s approval ratings this week in polls — including the Post-Ipsos poll and others from Reuters, Quinnipiac University, CNN and Gallup — have ranged from 44 percent to 47 percent. In all of them, more disapprove than approve of him.

That’s a reversal from the vast majority of previous polls, which showed Trump in net-positive territory.

And in the Post-Ipsos poll, significantly more Americans strongly disapprove of Trump (39 percent) than strongly approve of him (27 percent).

Americans oppose it by 21 points in the Post-Ipsos poll (59-38) and 25 points in the CNN poll (53-28).

The public’s opposition to tariffs based on the recognition that they get passed through to prices is really impressive to me. Why? Because this is a complicated issue, involving the incidence (who ultimately pays) of a tax. But the media, to its credit, has been far less “some say the earth is flat, others say round” on this one. That’s been helpful and it’s breaking through (see statement I bolded below).

The CNN poll shows Americans oppose his tariffs on aluminum and steel by 15 points (49-34), while the Post-Ipsos poll shows nearly 2-to-1 opposition to his 25 percent tariffs on goods from Mexico and Canada. About 7 in 10 Americans think tariffs generally increase the price of products in the United States.

Still another is the firings of large numbers of government workers, which is opposed by 19 points (58-39) in the Post-Ipsos poll.

About the only Trump proposals on which Americans lean in support are the 10 percent tariffs on China (50-45) and mass deportation (51-45).

But even that last one comes with a major caveat: Americans strongly oppose deporting undocumented immigrants who aren’t criminals (57-39), who arrived as children (70-26) and who have U.S. citizen children (66-30).

We’ll see how these numbers evolve, but my guess is we’re seeing the tip of an iceberg.

“More worrisome” because “well-anchored”—meaning steady, stable—longer-term inflationary expectations are a critical component in getting inflation back down to target. If the Fed picks up even a whiff of de-anchoring, they’ll very likely get a lot more hawkish. However, the partisanship caveat at the end of this section holds for this variable as well.

Great write up Jared. 57% oppose and 39% favor the deportation of undocumented immigrants who aren't criminals is interesting. Calling them undocumented rather than illegal makes a difference. What does criminal mean? To Trump a criminal is easy to identify as violent with a serial number to identify their "bad genes". But a criminal is someone who has been convicted of a crime. A person is innocent until proven guilty. Ex-convicts have served their time. So a criminal would be in jail already. Those not in jail have not been convicted and those who served their time have paid their dues to society and are free to live their lives. Deporting only violent criminals both drastically simplifies how hard it woud be to actually do such a thing and relies ultimately on racism.

Bong, bong, bong goes the death knell, reverberating through the town.