Weekly Wrap: Learning the Right Lessons from the Trade War, UI Claims, and a Necessary (Non-econ!) New Feature

Another tough week for rational economic policy. And some recommendations for healthy ways to take a break from the relentless cray-cray.

I yield to no one—NO ONE—in my disdain for Trump’s trade war.

I’d further argue that my antipathy should get more weight than that of many of my economist brothers and sisters. They’ve always disdained any actions against what they call “free trade,” while I’ve long worried about both the economics and politics of those hurt by globalization. (Why the scare quotes? Have you ever read a free-trade agreement? They’re hundreds and even thousands of pages of trade rules, some of which are protectionist (e.g., BigPharma in the house), others of which favor an industry whose lobbyist made it to the negotiating table, and, to be fair, many of which are just necessary rules of the road, e.g., how the signatories define rubber-tires, grade 4.)

It is also extremely important not to let up on tracking the trade war’s impact, especially as it really hasn’t reached the real economy in the negative way I believe it will (see UI claims below). The basic pattern is that markets and survey data lead the real data (jobs, growth, inflation, incomes), though, especially when it comes to consumers’ vibes, that gap has been wide and persistent. Price effects in particular are very likely coming, and when they do, this trade war is going to go from very unpopular to being seen by all as what it is: one of the biggest self-inflicted economic wounds of our time.

But that isn’t the end of the story. It’s wrong to conclude from this debacle that opposition to Trump’s trade war is the whole ballgame. In fact, Democrats have an opportunity to take the globalization debate to a higher, more accurate, and ultimately more beneficial level.

Let’s start with the facts.

--There are large swaths of this country wherein communities have been hurt by the loss of factory jobs (for those in denial about that, you can read this as “believe themselves to have been hurt…”). As was clear in this recent Daily episode, many voters in such places credit Trump with recognizing this problem, with feeling their pain, and with offering them a solution, even if, as many are starting to see, it’s a wrong solution.

--Trump is masterful at tapping this resentful force but he has no idea what to do about it. He is far more likely to make things much worse, not just in the trade space but in all spaces. His skill is winning, not governing.

--Sweeping tariffs are terrible economic policy. They won’t bring back factories, they’ll hurt domestic production (which depends on imported inputs), invoke retaliation, raise prices and interest rates, and even undermine the U.S.’s long-held safe-haven status.

--Just as in Trump 1, if he screws up the economy enough, his side may lose regardless of who they run. But there’s a non-zero chance he’ll keep blinking, that the economy will be okay, and that his successor will tap the same discontent from the first bullet above.

My point is that the lesson of Trump’s disastrous actions is almost surely not that people who perceive themselves as hurt by globalization have finally realized that their jobs are not coming back. They do not believe they were wrong to oppose trade agreements, or that they’ve overly down-weighted the benefits of imports. Or that they should disregard the next guy/gal who comes along promising to bring back the factories.

From what I can tell—and I’m a political economist, not a politician or pollster—for a lot of voters in electorally critical places, NAFTA and China’s accession to the WTO are still pretty fresh wounds.

But the train-wreck of the Trump trade war creates an opening for the argument that yes, trade has costs, but it also has benefits, and to ignore those benefits is to court higher prices and lower living standards. There are things we import that we can’t grow here. We’re a lot better off designing iPhones than assembling them.

But those increasingly self-evident truths do not obviate a policy to make more things here. I’ve made this case in many places, often referencing our industrial policy in the Biden administration, but the point was underscored effectively in a podcast debate from the other day.

I couldn’t listen to the whole debate, which went on forever and generated more heat than light. It’s especially grating to hear team Trump defend the trade war, as it invariably involves backfilling your own favorite version of what Trump’s up to, which, in turn, has little connection to what he’s actually up to, which, in turn, changes every hour.

But when one of the Trump defenders ticked off his version of what the goal was—more resilient supply chains with more domestic production of certain key goods, greater energy production, domestic semiconductor production, Ezra Klein correctly replied, “I agree with all of that but what it sounds like is an excellent argument for Joe Biden’s policies.”

We didn’t get everything right—far from it. We didn’t do enough Abundance-style reforms to speed production; while we had a great record on boosting energy supply, including renewables, we didn’t advertise it. Some of our protectionism (the Nippon steel deal) was excessive.

But the bones of an effective strategy to build more here were solidly in place, and, most importantly, it was working! We were pulling in private investment, foreign direct investment, and, of course, public investment, all in service of building domestic capacity in key, strategic sectors—the very ones the Trump guy called for!—and much of this building remains underway.

If Democrats can’t draw that distinction between what works in this space and what Trump is doing, they should find other work.

UI Claims are still not flashing red, and yet…

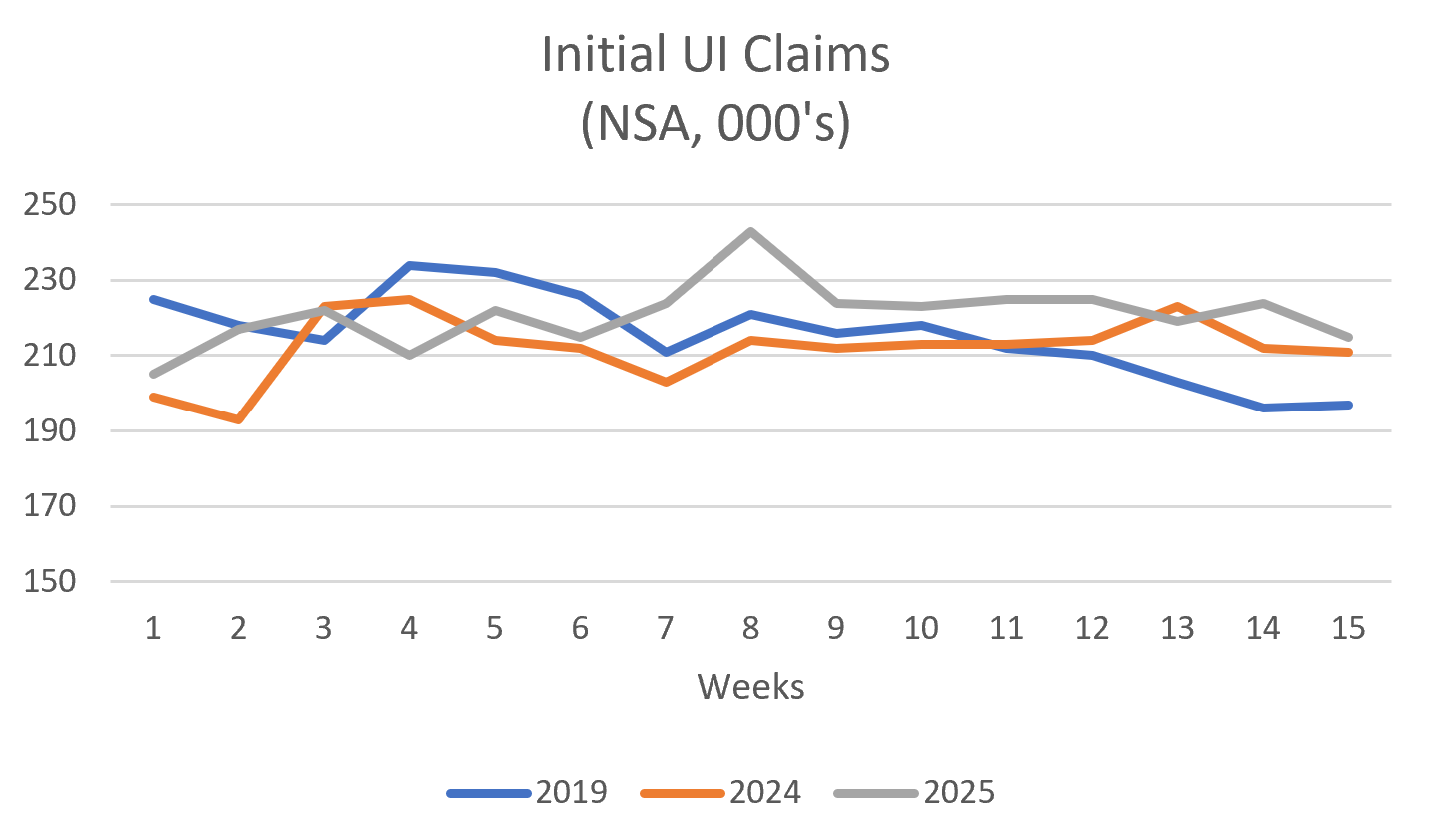

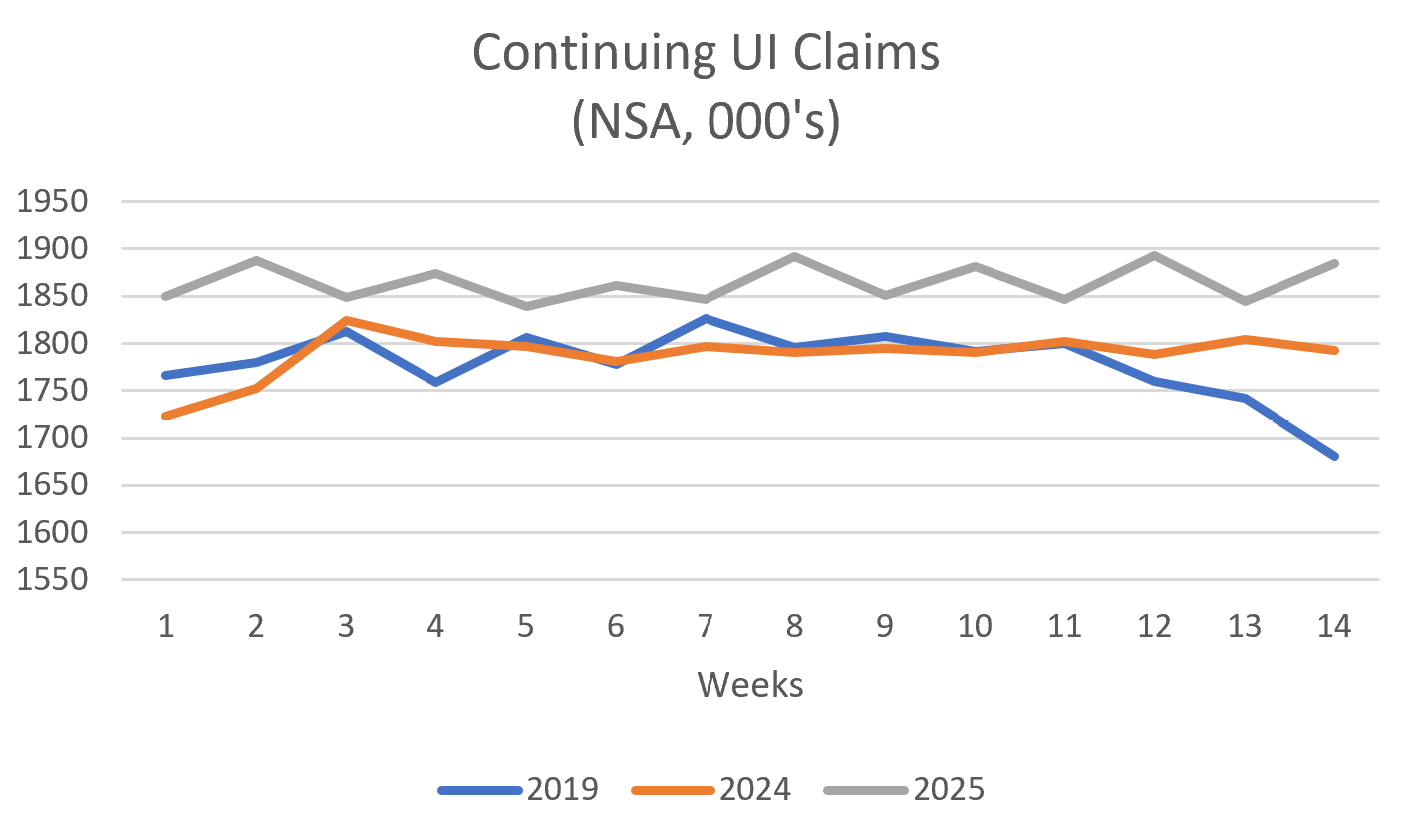

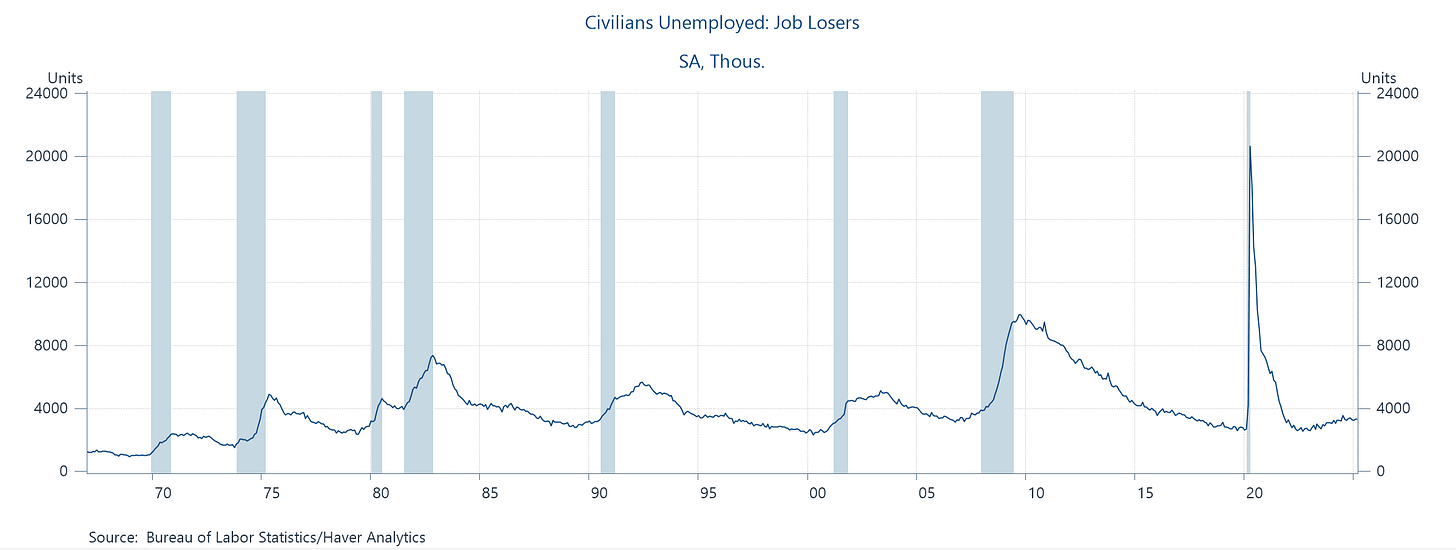

Layoffs are not accelerating, at least not yet (first two figures below). And you can’t really have a recession without higher layoffs (third figure).

The first figure shows initial UI claims, without any adjustments—just the raw data—for the first 15 weeks of 2019, 2024, and 2025. ‘19 and ‘24 were very good labor market years, and so far, ‘25 looks about the same, at least re initial claims. In addition, at least through March, the more comprehensive BLS jobs reports have also looked good.

The same type of figure for continuing claims—the stock of folks stuck on UI (vs. the flow of the initial claims)—is a bit more revealing of a softening in the job market. Claims for this year are elevated relative to ‘19 and ‘24. They’re not hugely so, but what you see there is the result of a real slowdown in the rate of hiring. Employers may not be laying workers off, but the rate at which they’re employing them has slowed.1

Now, there’s no reason to assume that a slower hiring rate means a downturn is imminent. It could just be that we’re in a pretty good labor-market equilibrium, with low unemployment and with enough job gains and hiring to stay where we are.

But with all the other stuff going on, the slightly elevated continuing claims and the slower hiring rate are worth keeping a close eye on.

New feature: TV, Music, Books!

Captain Obvious reporting in with the observation that we all need some time away from the relentless awfulness coming out of the White House. My personal places to go are streaming TV, music, and books (which I listen to as much as I read, esp. when exercising, which is also essential these days).

Now, I of course have no critical advantage in these areas so consider this more of a conversation, a place to share things to watch, listen to, read, and to bat around ideas about them.

For example, I’m having a fair bit of trouble finding good shows to watch because too many of them—a disproportionate share, it seems to me—are filled with characters who are jerks and a—holes. Maybe in normal times this would be fine, but in today’s context, it seems highly problematic.

I can’t bear to even try to watch season 3 of White Lotus, as from what I can tell, they’re all awful. I’m sort of enjoying Friends and Neighbors, but it’s pretty much one maybe-slightly-less-awful rich jerk dunking on all the other rich jerks. And while I thoroughly enjoyed season 1 of The Last of Us, this season just feels like an amplified take on a lot of what goes on Mon-Fri.

Don’t get me wrong. I’m not saying everything should be saccharine Ted Lasso (though that show was often an excellent antidote to what I’m describing). But this is a market failure. There’s an opening for more nuanced shows where some of the characters are, you know, decent people.

Turning to music, while I consistently and unapologetically default to Bach and Mozart, later this week I’m going to hear A German Requiem by Brahms, and I promise you that if you’re at all open to classical music, this piece is truly other worldly. Beyond sublime. If you let yourself get lost in it, it will cleanse you, lastingly so, of much of the toxicity of what we’re living through.

Finally, with apologies for lying about this new feature getting away from econ, I’m deeply and happily ensconced in John Cassidy’s new book, Capitalism and Its Critics. Cassidy is one of my favorite economic writers (he writes for The New Yorker), in no small part because of his sweeping historical scope, which is in full evidence in this book (his book on the financial crisis “How Markets Fail” is, for my money, among the best on the topic). And talk about timeliness—capitalism as we’ve come to know it has…um…some issues, and I’m finding Cassidy’s journey though the ages with its critics, to whom the author is often sympathetic, to be enlightening.

Also, I’m interviewing him on the new book here in DC in a few weeks! Come say hi!

If you’re thinking these raw numbers should be scaled by something, like the labor force, I agree and will do so at some point.

Many great comments and suggestions here! I've been thinking about checking out Britbox and see numerous plugs for Scandinavian TV. Will go try some right now!

Great and fair analysis. I'm no economist, but I know your knowledge/advice had a lot to do with economic successes of the Biden years. Paul Krugman has rightly pointed out your policies were the most progressive policies since FDR's New Deal designed to address some of tbe main complaints of Trump voters. Yes, it is right for Democrats to acknowldedge their role in allowing the negative effects of free trade and globalization without compensation for many lost jobs.

But globalization has also brought good. For instance, I am working in the tea industry (and am a tea nerd). The tariffs are going to hurt our business in a big way--tea (as well as coffee and some wines) will never be grown/processed on any quality scale in the US--it is senseless to tariff it. That goes for many other items which we will either no longer be able to get or not get at all--and the prices of what we can get will increase to the point of putting many out of business.

I've been attending the symphony

more (Brahms Requiem is a favorite--I recently attended a performance of Brahms Symphony #4, also a favorite).

Thank you, sir, for your service. You and President Biden did a marvelous job. It's so tragic that so many didn't appreciate it--I think a communication failure of the Administration AND that of mainstream media.